stornik.ru

Overview

Chime Banking Institution

Chime makes managing your bank account easy and empowering. Our beloved online banking app delivers all the tools you need, right at your fingertips. I cancelled a savings account last week with Ally Bank and I'm trying to open a 2nd checking account (just for spending) with Chime but I got rejected. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Best Online Bank Alternatives to Chime · Ally · Aspiration · Axos Bank · Capital One · Current · Discover Bank · One Finance · Quontic. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. Chime is a financial technology company that provides online banking services, while Bancorp Bank is a traditional financial institution. The relationship. So if you go into settings, set up direct deposit, and click get completed form it will show you which bank that your chime account is backed by. Chime offers a checking account with no minimum balance fees and no monthly fees. No fees for overdrafts. Rather than a traditional bank, Chime is a financial technology company that partners with banks to create affordable banking and financial offerings. Its. Chime makes managing your bank account easy and empowering. Our beloved online banking app delivers all the tools you need, right at your fingertips. I cancelled a savings account last week with Ally Bank and I'm trying to open a 2nd checking account (just for spending) with Chime but I got rejected. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Best Online Bank Alternatives to Chime · Ally · Aspiration · Axos Bank · Capital One · Current · Discover Bank · One Finance · Quontic. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. Chime is a financial technology company that provides online banking services, while Bancorp Bank is a traditional financial institution. The relationship. So if you go into settings, set up direct deposit, and click get completed form it will show you which bank that your chime account is backed by. Chime offers a checking account with no minimum balance fees and no monthly fees. No fees for overdrafts. Rather than a traditional bank, Chime is a financial technology company that partners with banks to create affordable banking and financial offerings. Its.

Deposits are FDIC insured up to $, through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. And we work hard to protect your information, such. Chime is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. *Early. Chime's high-yield savings account doesn't charge a fee or require a minimum deposit. Learn more about Chime savings account interest rates and other. NEW Online Banking is Here! · Home Loans · Trucking & Heavy Equipment · Commercial Real Estate · Healthcare Banking · Farm Loans · Commercial & Industrial Loans · Bank. * Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime. In December Business Insider included Chime as a company anticipating a IPO, stating “The digital bank denied it had immediate plans for a public. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. that use “banking” terminology that Chime is a financial technology company, not a bank, and banking services are provided by Chime's. Banking Partner(s). Top online banks like Chime include Varo, SoFi, Current, Axos, Capital One, Step, Dave and Fizz. See how these Chime alternatives compare. Chime is a financial technology company that offers digital banking services, including checking accounts, savings accounts, and debit cards. Need to open a bank account and have a bad credit score? Open a second chance banking account through Chime with no credit check or minimum deposit. The company was founded in and is based in New York, New York. A. Atom Bank. Atom Bank is a financial institution that provides an online banking platform. members of the UC community may have been used in attempts to open unauthorized bank accounts at financial institutions such as Chime and Go2Bank. Some of. Chime is a financial technology company that, with its bank partners, offers online checking and savings accounts as well as a credit-building secured credit. Open your Chime checking account online for free and easily manage your money 24/7. No monthly service fees, access fee-free ATMs. Top online banks like Chime include Varo, SoFi, Current, Axos, Capital One, Step, Dave and Fizz. See how these Chime alternatives compare. Banking. Wealth. Personal finances. Business finances. Payment. Lending. M1 Finance. Simple. Chime. Oportun. Oportun uses financial data to help you save a. Chime® is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. that use “banking” terminology that Chime is a financial technology company, not a bank, and banking services are provided by Chime's. Banking Partner(s).

Making Money With Uber Eats

Getting Paid · Instant cash out. Get your earnings within minutes* when you cash out in the Uber Driver app. · Next-day cash out. Get your earnings within one. On average, Uber Eats drivers earn around $8 to $12 per hour after expenses. But if you're willing to ride the high tides of lunch and dinner times, you could. In this blog, we'll explore the strategies and techniques that can show you how to earn $ per week as an Uber Eats delivery driver. When demand increases, earnings for rides and deliveries go up · Keep an eye out for surge pricing to earn extra money. Driving for Uber Eats allows you to deliver food to customers from hundreds of different restaurants around the world while receiving around $6 to $7 for each. 7 Uber Eats Driver Hacks To Rake In More Money · 1. First, Understand How It All Works · 2. Cash In On Promotions · 3. Work At The Right Times · 4. Location. Use this page to understand all of the earning opportunities for making money with Uber Eats. Learn how to decide when and where it's best to deliver. Uber Eats' business model combines a multi-sided platform, aggregator, and on-demand. The model includes customers, delivery partners, and restaurant partners. Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. Depending on how many deliveries you make per week and the hours worked. Getting Paid · Instant cash out. Get your earnings within minutes* when you cash out in the Uber Driver app. · Next-day cash out. Get your earnings within one. On average, Uber Eats drivers earn around $8 to $12 per hour after expenses. But if you're willing to ride the high tides of lunch and dinner times, you could. In this blog, we'll explore the strategies and techniques that can show you how to earn $ per week as an Uber Eats delivery driver. When demand increases, earnings for rides and deliveries go up · Keep an eye out for surge pricing to earn extra money. Driving for Uber Eats allows you to deliver food to customers from hundreds of different restaurants around the world while receiving around $6 to $7 for each. 7 Uber Eats Driver Hacks To Rake In More Money · 1. First, Understand How It All Works · 2. Cash In On Promotions · 3. Work At The Right Times · 4. Location. Use this page to understand all of the earning opportunities for making money with Uber Eats. Learn how to decide when and where it's best to deliver. Uber Eats' business model combines a multi-sided platform, aggregator, and on-demand. The model includes customers, delivery partners, and restaurant partners. Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. Depending on how many deliveries you make per week and the hours worked.

While ZipRecruiter is seeing hourly wages as high as $ and as low as $, the majority of Uber Eats Delivery Driver wages currently range between $ On average, UberEats drivers usually make about $18 per hour before expenses, making this a potentially decent income. Uber Eats is a nice option to earn money in between jobs. You can set your own hours and days you wish to work. Pay is immediate, so no waiting for a paycheck. That said, assuming you're in a busy market, you'll probably make around $$20 per hour if you only use Uber Eats. But that's not the end of the story. That's. Earn money. You'll get paid for every pickup and dropoff you complete, plus a per-mile rate. In some cities, you'll also receive a per-minute rate. In. Your business will be discovered more frequently in the Uber Eats app² · Uber One benefits ($0 Delivery Fee and discounts) apply to member customers ordering. Virtual restaurants let you offer delivery-only menus on Uber Eats from your existing kitchen. It's a new way to drive revenue and meet local demand. Here are 11 tips on how to round up, earn more money by delivering food with Uber Eats. The opportunities to easily earn more money with Uber Eats exist. Uber Eats delivery drivers earn anywhere from $ to $ per hour. The amount delivery partners earn depends on their location, delivery fee, surge pricing. This Uber Eats driver made $ in one month delivering food 12 hours a day. Here's how he did it — and documented the journey on Tik Tok. When you deliver with the Uber Eats app, your earnings are transferred automatically, so you don't have to worry about paperwork. Find out how to set up. Making More Money as a Uber Eats Driver In any case, if you want to make $ per week working as an Uber Eats driver, you must take your driving seriously. Refer friends and family to drive for Uber Eats to receive a bonus. To earn extra money with little effort, encourage your loved ones to become a driver like. Doing Uber Eats can be a great way to earn extra money in your spare time. With Uber Eats, you get to set your own schedule and be your own boss. On average, UberEats drivers usually make about $18 per hour before expenses, making this a potentially decent income. Uber Eats drivers typically earn between $ and $ per hour, based on city-specific data. This translates to an annual income range of approximately. App has been a great filler for a part time job, and allows you to make money that is suitable for you. There are some bugs though, such as the acceptance. It's your hustle. Our flexibility. Your independence. Our security. Your business. Our support. Here's why you should drive, deliver, and earn money with. Pay can vary quite a bit from day to day and hour to hour, so working during the dinner and lunch rush hours or “Promotion Boost” hours will allow you to earn. How can I work with UberEats? UberEats delivery drivers are also self-employed. Working with UberEats should give you the flexibility to work the hours you want.

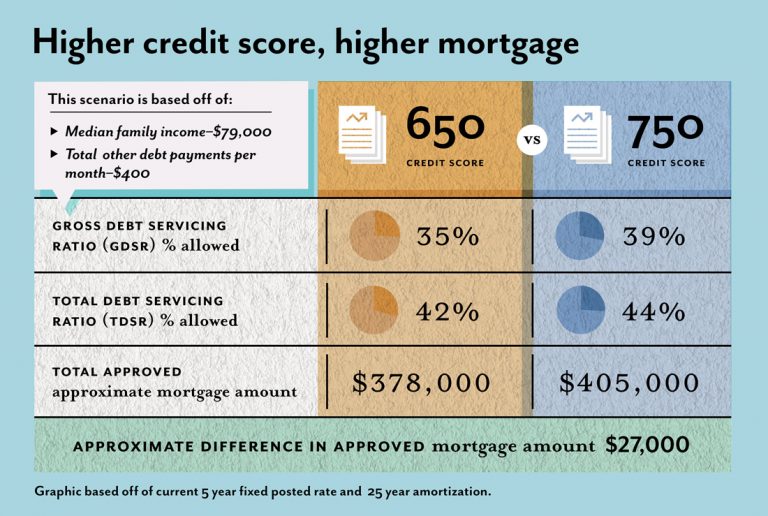

Does My Credit Score Affect My Mortgage Rate

Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly. If you have a high credit score, you will likely have more home loan options available to you (including lower interest rates). An average credit rating will. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount. My experience shows you will get the best rate if your credit score is over for most lenders. But, rate is determined not just by your credit score. Here's why: Your FICO® Score is typically used (credit scores rank from ) with a mortgage credit inquiry estimated to lower your credit score a mere No matter what type or size of loan you see, there is no variance between a credit score mortgage rate, an credit score mortgage rate and an credit. If you appear to be high risk, expect a higher interest rate. (Or, if your credit score is really low, you may be denied.) On the other hand, if you're low risk. With mortgages, you can get your credit report pulled by additional lenders with no further impact to your credit score as long as you submit additional. So your credit score is a critical factor in regards to mortgage rates. Still, if you have a low credit score, take heart; it's just one factor in a broader set. Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly. If you have a high credit score, you will likely have more home loan options available to you (including lower interest rates). An average credit rating will. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount. My experience shows you will get the best rate if your credit score is over for most lenders. But, rate is determined not just by your credit score. Here's why: Your FICO® Score is typically used (credit scores rank from ) with a mortgage credit inquiry estimated to lower your credit score a mere No matter what type or size of loan you see, there is no variance between a credit score mortgage rate, an credit score mortgage rate and an credit. If you appear to be high risk, expect a higher interest rate. (Or, if your credit score is really low, you may be denied.) On the other hand, if you're low risk. With mortgages, you can get your credit report pulled by additional lenders with no further impact to your credit score as long as you submit additional. So your credit score is a critical factor in regards to mortgage rates. Still, if you have a low credit score, take heart; it's just one factor in a broader set.

High credit score = good interest rate. Low credit score = not as good of an interest rate. We'll get to why a low interest rate – even a fraction lower –. How Does Your Credit Affect Your Interest Rates? The higher your credit score, the lower your interest rate may be on a mortgage or any other type of loan. Does my credit score affect my mortgage rate? Yes, your credit score can influence your mortgage rate. Past financial decisions as reflected in your credit. Should I pay points to lower the rate? What will my closing costs be? An Your lender or insurer may use a different FICO® Score than the versions. A higher credit score can help you secure a lower interest rate, which can save you thousands of dollars over the life of your mortgage. To improve your credit. In general, the higher your credit score is, the better your mortgage options will be. Your credit score, the type of rate you choose and your property's. If your credit score is in the highest category, , a lender might charge you percent interest for the loan. This means a monthly payment of $ A credit score plays a significant role in obtaining the best mortgage rates because lenders use it to assess the borrower's creditworthiness. Does your credit score affect mortgage rates? Yes. However, does a higher credit score give you better rates? No! If one borrower has a good. If you're thinking about refinancing your mortgage, although you may gain an improved loan, it also may negatively affect your credit score. The simple answer: a lot. That's why you'll want to know your credit rating well before applying for a mortgage — something only 67% of Canadians aged 18 to Your credit score will influence your mortgage rate in Canada. The type of mortgage or lender will determine the down payment, and the borrowing rate you can. A credit score plays a significant role in obtaining the best mortgage rates because lenders use it to assess the borrower's creditworthiness. Keep in mind that you'll need a high down payment amount if you have a credit score below And your interest rate will be much higher! VA Loans. The U.S. Keep in mind that you'll need a high down payment amount if you have a credit score below And your interest rate will be much higher! VA Loans. The U.S. Higher credit scores will help you get the best terms possible while lower scores could keep you from your dream of homeownership. As a mortgage broker, we've seen some great individuals miss out on their dream home because of unexpected credit issues. Becoming more familiar with how your. A borrower's credit score is the single most important determining factor of mortgage rates that lies within an individual's control. Lenders can set their own levels, but typically a borrower with a credit score of or higher will receive the best interest rate on a mortgage. A point. A: There is some good news for you; the FHA will not penalize your loan's interest rate based on a lower credit score. Since FHA mortgage rates don't include.

What Are The Best Options For First Time Home Buyers

Check out National Homebuyers Fund, Chenoa Fund, and Neighborhood Assistance Corporation of America. A few lenders also offer assistance, for. DPA Loans and grants: There are a variety of options available for down payment assistance loans and grants. Check with your NAF Loan Officer to see which. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans. First-Time Homebuyer Programs by State · Down payment assistance grants are typically need-based gift money that doesn't need to be repaid. · Down payment. TSAHC provides downpayment assistance to homebuyers, helps developers build affordable housing, and helps homeowners prevent foreclosure. Qualifying for Florida Housing First-Time Homebuyer Benefits · Florida HFA Preferred Conventional Loan · Florida HFA Preferred 3% Plus Conventional Loan · Salute. 1. Know how much cash you'll need at closing. · 2. Budget for private mortgage insurance. · 3. Research your utilities. · 4. Don't forget miscellaneous expenses. With a mortgage loan through the Department of Agriculture, buyers can skip down payments altogether. USDA loans are offered as a financial incentive to. Explore Mortgage Options A good start for exploring different mortgages is to compare conventional loans to FHA loans. An FHA loan for first-time home buyers. Check out National Homebuyers Fund, Chenoa Fund, and Neighborhood Assistance Corporation of America. A few lenders also offer assistance, for. DPA Loans and grants: There are a variety of options available for down payment assistance loans and grants. Check with your NAF Loan Officer to see which. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans. First-Time Homebuyer Programs by State · Down payment assistance grants are typically need-based gift money that doesn't need to be repaid. · Down payment. TSAHC provides downpayment assistance to homebuyers, helps developers build affordable housing, and helps homeowners prevent foreclosure. Qualifying for Florida Housing First-Time Homebuyer Benefits · Florida HFA Preferred Conventional Loan · Florida HFA Preferred 3% Plus Conventional Loan · Salute. 1. Know how much cash you'll need at closing. · 2. Budget for private mortgage insurance. · 3. Research your utilities. · 4. Don't forget miscellaneous expenses. With a mortgage loan through the Department of Agriculture, buyers can skip down payments altogether. USDA loans are offered as a financial incentive to. Explore Mortgage Options A good start for exploring different mortgages is to compare conventional loans to FHA loans. An FHA loan for first-time home buyers.

Eligibility Calculator Most people borrow the large amount of money they need to buy a home. This type of borrowing is called a first mortgage loan. There are. OHFA offers year, fixed-rate FHA, VA, USDA-RD & conventional mortgage loans with income & purchase price limits for buyers with low- and. Grants and specialized loan programs for first-time homebuyers are available in cities and counties throughout the United States. These programs provide down. Offers eligible first-time homebuyers the lowest year fixed interest rate available from the program for a home loan. (Mortgage credit certificates may not. The First Time Home Buyer Incentive is a shared equity mortgage without monthly payments. This CMHC program provides an option for first-time buyers to borrow. There are a variety of financing options available to first-time homebuyers—including conventional mortgages and government-backed loans. 1. Get credit ready. · 2. Know what you can afford. · 3. Start saving for your down payment. · 4. Find a lender you can trust. · 5. Explore your mortgage options. For many applicants, including those that do not qualify for a conventional loan, will likely find an FHA loan to be the best loan option. The current basic. Find out if you qualify for down payment assistance programs, mortgage revenue bonds, or other programs designed to reduce the up-front cost of buying a home. First time buyers have a few financing options through OHFA, including FHA, VA, USDA Rural Development and conventional mortgage loans with affordable year. The NC 1 Home Advantage Down Payment offers $15, in down payment help that may provide a better boost for new buyers than the other down payment options. Tips and Resources for First Time Home Buyers · Take Advantage of Free Home Buying Seminars and Classes · Determine How Much Home You Can Afford · Check Your. DPA Loans and grants: There are a variety of options available for down payment assistance loans and grants. Check with your NAF Loan Officer to see which. Home One - Low down payment option for purchase or refinance of single family property. · Home Possible - Perfect for the entry level homebuyer for a unit. Find out if you qualify for down payment assistance programs, mortgage revenue bonds, or other programs designed to reduce the up-front cost of buying a home. Down Payment Assistance - Most Great Choice Home Loans are insured by FHA or USDA-RD, which means you may be eligible to borrow up to % of the total price. Another program to check out is FHA Plus, which also combines year fixed rate mortgage loans with down payment assistance for the purchase of a primary home. To qualify, the buyer must obtain a fixed-rate first trust deed loan; have adequate income, a good credit rating; and provide a minimum down payment of 3. The down payment assistance is up to 3 percent or percent depending on the loan program, so that buyers can have percent financing if needed. The second. With a mortgage loan through the Department of Agriculture, buyers can skip down payments altogether. USDA loans are offered as a financial incentive to.

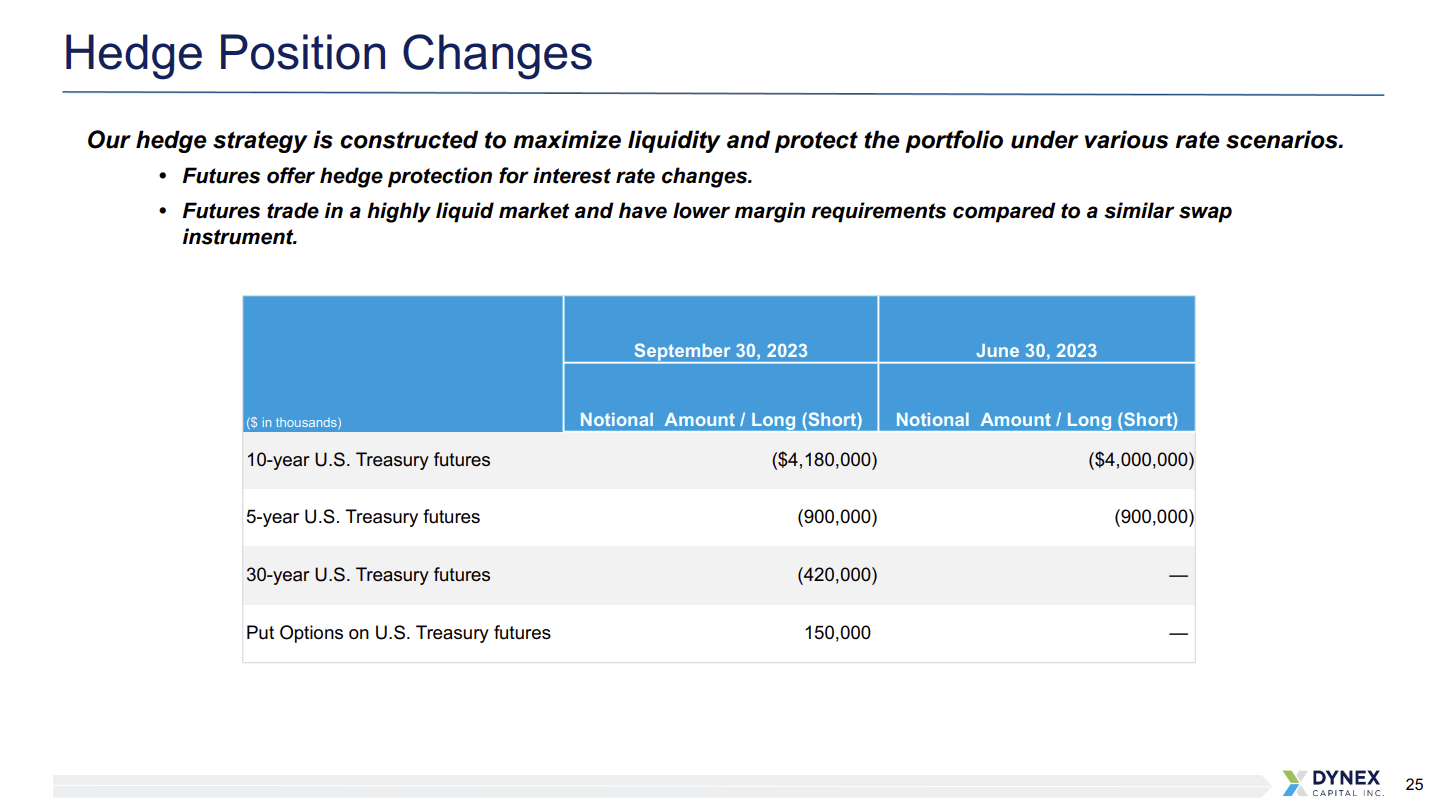

Dynex Reit

Formed in , Dynex Capital, Inc. (NYSE: DX) is an internally managed real estate investment trust, or REIT, which invests in mortgage assets on a leveraged. Step 1: Choose where to buy Dynex Capital stock. You need an online brokerage account in order to access the NYSE market and buy DX shares. Dynex Capital, Inc. is a real estate investment trust, or REIT, which invests in mortgage loans and securities on a leveraged basis. Dynex Capital, Inc., which commenced operations in , is an internally managed mortgage real estate investment trust, or mortgage REIT, which primarily. Dynex Capital, Inc., a mortgage real estate investment trust, invests in mortgage-backed securities (MBS) on a leveraged basis in the United States. Sector comparison Dynex Capital, Inc. Mortgage REITs (Real Estate) - Sector performance stornik.ru Discover real-time Dynex Capital, Inc. Common Stock (DX) stock prices, quotes, historical data, news, and Insights for informed trading and investment. View today's Dynex Capital Inc stock price and latest DX news and analysis. Create real-time notifications to follow any changes in the live stock price. Dynex Capital, Inc. is an internally managed mortgage real estate investment trust. It engages in the business of investing in mortgage-backed securities. The. Formed in , Dynex Capital, Inc. (NYSE: DX) is an internally managed real estate investment trust, or REIT, which invests in mortgage assets on a leveraged. Step 1: Choose where to buy Dynex Capital stock. You need an online brokerage account in order to access the NYSE market and buy DX shares. Dynex Capital, Inc. is a real estate investment trust, or REIT, which invests in mortgage loans and securities on a leveraged basis. Dynex Capital, Inc., which commenced operations in , is an internally managed mortgage real estate investment trust, or mortgage REIT, which primarily. Dynex Capital, Inc., a mortgage real estate investment trust, invests in mortgage-backed securities (MBS) on a leveraged basis in the United States. Sector comparison Dynex Capital, Inc. Mortgage REITs (Real Estate) - Sector performance stornik.ru Discover real-time Dynex Capital, Inc. Common Stock (DX) stock prices, quotes, historical data, news, and Insights for informed trading and investment. View today's Dynex Capital Inc stock price and latest DX news and analysis. Create real-time notifications to follow any changes in the live stock price. Dynex Capital, Inc. is an internally managed mortgage real estate investment trust. It engages in the business of investing in mortgage-backed securities. The.

Stock Exchange> Real Estate Investment Trusts> Dynex Capital, Inc. Dynex Capital, Inc. DX. Dividend Summary. The next Dynex Capital, Inc. Our goal at stornik.ru is simple, to provide as much information as we can about REITs (Real Estate Investment Trust). We don't promise to have all the. Dynex Capital, Inc. is an internally managed mortgage real estate investment trust (mortgage REIT). The Company primarily invested in Agency MBS including. Dynex is a financial services company committed to ethical stewardship of stakeholders' capital, expert risk management, disciplined capital allocation, and. Dynex Capital, Inc. is an internally managed mREIT that manages a diversified, high-quality, leveraged fixed-income portfolio. Dynex Capital, Inc. is a real estate investment trust, or REIT, which invests in mortgage loans and securities on a leveraged basis. Dynex Capital, Inc. is a real estate investment trust, or REIT, which invests in mortgage loans and securities on a leveraged basis. Dynex Capital Keeps Q2 Dividend Steady The REIT will again pay $ per share. The 7 Highest Potential Returns in Mortgage REITs. Dynex Capital, Inc. operates as a mortgage real estate investment trust. The company primarily invests securitizing single-family and commercial mortgage. Dynex Capital, Inc. operates as a mortgage real estate investment trust. The company primarily invests securitizing single-family and commercial mortgage. A mortgage real estate investment trust, invests in mortgage-backed securities (MBS) on a leveraged basis in the United States. real estate assets in the United States. Dynex operates as a REIT and is internally managed. CURRENT PRICE. DX:USUSD. ++%. As of PM EDT 09/ Dynex Capital, Inc. is an internally managed mortgage real estate investment trust. It engages in the business of investing in mortgage-backed securities. Dynex Capital Inc is an internally managed mortgage real estate investment trust, which invests in mortgage-backed securities. Dynex Capital, Inc. is an internally managed mortgage real estate investment trust (REIT), which invests in mortgage-backed securities (MBS). ARMOUR Residential REIT, Inc. $ ARR %. Horizon Technology Finance Corp. $ HRZN %. Gladstone Capital Corporation. $ GLAD %. Dynex Capital, Inc. is an internally managed real estate investment trust, or REIT, which invests in mortgage assets on a leveraged basis. What are mortgage REITs? + Why should I invest in REITs? Isn't the real estate market risky? + How has the Real estate market evolved since Get Dynex Capital Inc (DX:NYSE) real-time stock quotes, news, price and financial information from CNBC. ynex Capital, Inc. is an internally managed real estate investment trust, or REIT, which invests in mortgage assets on a leveraged basis.

Bts Concert Age Limit 2021

The septet co-writes and produces much of their output. Originally a hip hop group, their musical style has evolved to include a wide range of genres. Their. BTS (also known as the Bangtan Boys, formed in ). Fast Facts. Full Name: Jeon Jung-kook. Nickname: Jungkook. Birth date: September 1, Age: Zodiac. South Korean boy band BTS has performed in five concert tours six fan meeting tours, four joint tours, eight showcases, and 41 concerts since their debut in. age for mandatory military service from 28 to 30, sparing Jin an early hiatus In February , BTS performed an MTV Unplugged set, which featured. On May 22, HYBE released an official announcement on their social media platform Weverse that read, "BTS MUSTER SOWOOZOO will be held as an online live-. M posts. Discover videos related to Bts Concert Age Limit on TikTok. See more videos about Rm Bts, Bts Mic Drop, Home Bts, Normalize Women Sagging Pants. Find out when BTS is next playing live near you. List of all BTS tour dates, concerts, support acts, reviews and venue info. Today. Clear. «,». Today. Clear. «,». Catch the record-breaking South Korean boy band BTS live when you attend their tour. If you need any help securing BTS tickets for an upcoming concert, get. The septet co-writes and produces much of their output. Originally a hip hop group, their musical style has evolved to include a wide range of genres. Their. BTS (also known as the Bangtan Boys, formed in ). Fast Facts. Full Name: Jeon Jung-kook. Nickname: Jungkook. Birth date: September 1, Age: Zodiac. South Korean boy band BTS has performed in five concert tours six fan meeting tours, four joint tours, eight showcases, and 41 concerts since their debut in. age for mandatory military service from 28 to 30, sparing Jin an early hiatus In February , BTS performed an MTV Unplugged set, which featured. On May 22, HYBE released an official announcement on their social media platform Weverse that read, "BTS MUSTER SOWOOZOO will be held as an online live-. M posts. Discover videos related to Bts Concert Age Limit on TikTok. See more videos about Rm Bts, Bts Mic Drop, Home Bts, Normalize Women Sagging Pants. Find out when BTS is next playing live near you. List of all BTS tour dates, concerts, support acts, reviews and venue info. Today. Clear. «,». Today. Clear. «,». Catch the record-breaking South Korean boy band BTS live when you attend their tour. If you need any help securing BTS tickets for an upcoming concert, get.

November 26, AM PSTUpdated 3 years ago. SEOUL, Nov 26 (Reuters) - When K-Pop sensation BTS announced that their first in-person. In , BTS delighted fans with their Permission to Dance On Stage Concert. Head to the official BTS store to explore a wide range of concert merchandise. Today. Clear. « The Great Pyramids of Giza. Price Range: EGP 60 - · MEMO. Sep 6 | Tickets at stornik.ru Photo shared by Ross Shor Lynch on BTS: @daretodane @hunjoe @skylerwagoner PAs: @sofiamreyess @fatimalreyess. BTS tickets range from $60 to $ USD face value per person (not including fees) at first sale value depending on where you sit. BTS (also known as the Bangtan Boys, formed in ). Fast Facts. Full Name: Jeon Jung-kook. Nickname: Jungkook. Birth date: September 1, Age: Zodiac. The septet co-writes and produces much of their output. Originally a hip hop group, their musical style has evolved to include a wide range of genres. Their. BTSBTS, popular among Generation Z, performs at the American Music Awards, (more). Also called: Gen Z, zoomers, iGeneration, centennials, post. Catch the record-breaking South Korean boy band BTS live when you attend their tour. If you need any help securing BTS tickets for an upcoming concert, get. I don't think that there's a lower limit, but to purchase items online you generally have to be above That said, I believe a parent can apply for you. 21st century pop icons BTS have announced their additional show dates for This concert will be the first time ever for BTS and ARMY to meet face to. There is a restriction on videography and livestreaming during the concert ➸ Permission to Dance on Stage in Los Angeles (). Their pre-debut single "Da Coconut Nut" was released on November 20, The group officially debuted on June 11, with the release of their debut single. Though I am quite sure they'll all be working on some music while enlisted, a concert takes considerably more planning than just a month or two. The show run began in Seoul, South Korea on October 24, , and concluded in Las Vegas, Nevada on April 16, Permission to Dance On Stage. Tour by BTS. BTSBTS, popular among Generation Z, performs at the American Music Awards, (more). Also called: Gen Z, zoomers, iGeneration, centennials, post. 21st century pop icons BTS have announced their additional show dates for This concert will be the first time ever for BTS and ARMY to meet face to. concert" held at Sofi Stadium in Los Angeles -. The ticket price concert in New Jersey and here's an idea for price range. I'm. BTS @gucci @sabatods @myleshendrik. Photo by Miley Cyrus on July 22, “Happy Hippie speaks to my fans at the age I was when it launched—18, 19, 20, South Korean boy band BTS has performed in five concert tours six fan meeting tours, four joint tours, eight showcases, and 41 concerts since their debut in.

Fidelity Company 401k

Wondering how to invest your (k)? Check out Fidelity's tips for investing your retirement plan to help set yourself up for potential long-term growth. A fidelity bond, or ERISA bond, is an insurance policy that provides a (k) plan with protection from losses caused by any fraudulent behavior. Help your employees get retirement ready with powerful, easy-to-administer (k) plans with Fidelity. Turn your (k) into a competitive business. Key Takeaways · In early , Fidelity Investments became the first firm to announce that employees could add crypto—in the form of Bitcoin—to their (k). Check with Fidelity to ensure you have the right application to open an investment-only brokerage account under your Solo k plan and trust. Seamless payroll integration for efficient (k) management. Connect now. About. Fidelity Investments offers a broad range. At Fidelity, we're committed to helping wealth managers expand their practice by incorporating (k) plans into their book of business. Get started today. Company · About Us · Core Values · Our Stories · Our Business · Suppliers · Executive View the Fidelity k Summary Plan Description · Visit the Fidelity. Looking to start a (k) for your small business? Discover Fidelity Advantage (k)℠ – an affordable, simple plan that's easy to manage. Wondering how to invest your (k)? Check out Fidelity's tips for investing your retirement plan to help set yourself up for potential long-term growth. A fidelity bond, or ERISA bond, is an insurance policy that provides a (k) plan with protection from losses caused by any fraudulent behavior. Help your employees get retirement ready with powerful, easy-to-administer (k) plans with Fidelity. Turn your (k) into a competitive business. Key Takeaways · In early , Fidelity Investments became the first firm to announce that employees could add crypto—in the form of Bitcoin—to their (k). Check with Fidelity to ensure you have the right application to open an investment-only brokerage account under your Solo k plan and trust. Seamless payroll integration for efficient (k) management. Connect now. About. Fidelity Investments offers a broad range. At Fidelity, we're committed to helping wealth managers expand their practice by incorporating (k) plans into their book of business. Get started today. Company · About Us · Core Values · Our Stories · Our Business · Suppliers · Executive View the Fidelity k Summary Plan Description · Visit the Fidelity. Looking to start a (k) for your small business? Discover Fidelity Advantage (k)℠ – an affordable, simple plan that's easy to manage.

Both companies offer plenty of educational material about retirement savings, asset allocation, compounding returns, and fund basics on their websites. Vanguard. Automatic Enrollment · Have you used Fidelity NetBenefits at a previous employer? · Do you have a brokerage account with Fidelity (or an IRA, mutual funds, or a. This comprehensive guide will walk you through everything you need to know about investing in a Fidelity (k). Taking a k loan or withdrawal | What you should know | Fidelity. Clicking Every employer's plan has different rules for (k) withdrawals and. Fidelity can help you design (k) plans for your small business with more than 20 employees. Offer competitive retirement benefits to your employees. Log in to Fidelity, and select the account you're looking for. Click on “Investments” on the main menu. Click on “Change Investments” on the secondary menu. A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. I'm new to investing at 29 years old. I make ~$47k pre-tax, but I live very frugally and plan to max out my k and Roth IRA to the best of my ability each. (k) Options. Tax-deferred and after-tax savings and retirement plans. Contact. Fidelity Investments. A (k) plan designed especially for you. With Fidelity, you have no account fees and no minimums to open an account. 4 options for your old (k) · 1. Roll over to Fidelity IRA · 2. Roll over to a new workplace plan · 3. Stay in your old (k) · 4. Cash out (and pay taxes). What K Plan benefit do Fidelity Investments employees get? Fidelity Investments K Plan, reported anonymously by Fidelity Investments employees. A (k) match is when your employer contributes money in your (k) account to reflect the contributions you've made out of your compensation, like salary. Fidelity (k) Plan Services currently manages our employer (k) plan. They provide free retirement services and a breadth of available investment options. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of. Conveniently manage your workplace benefits from Fidelity—from sending us documents to accessing your retirement savings, stock options, health insurance. This is your annual salary from your employer, before taxes and other benefit deductions. Since your contribution and employer match are based on the salary. Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. (k) Fidelity is an employer-sponsored retirement plan offered by Fidelity Investments to help individuals save for their retirement. The (k) Fidelity plan.

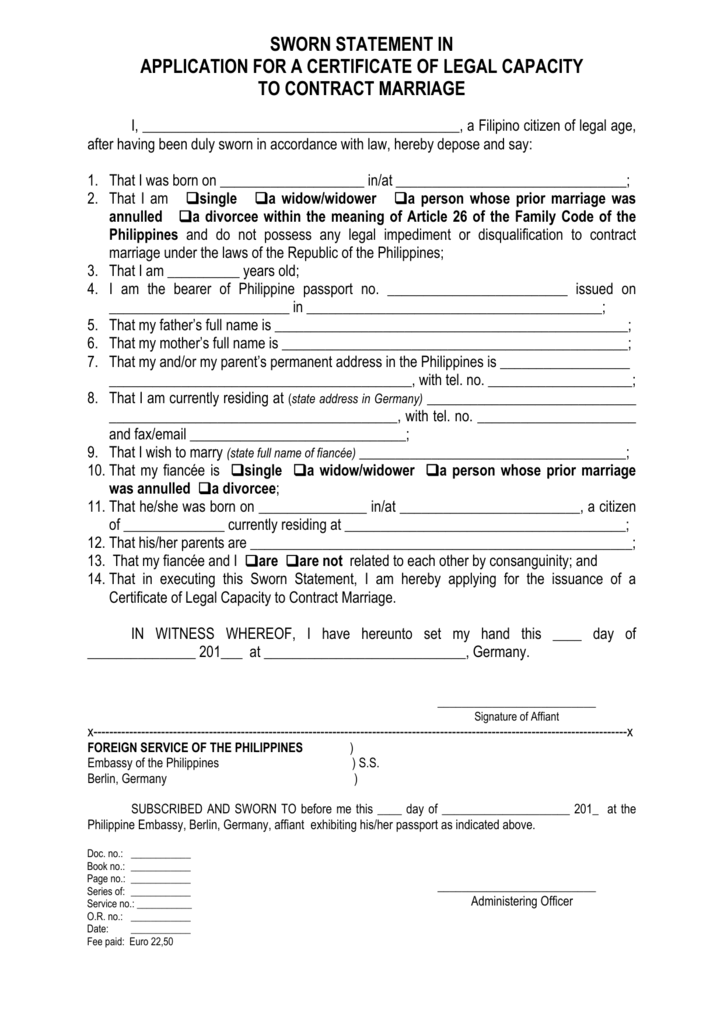

How To Get A Contract Marriage

Ensuring that the marriage contract is legal and binding, the safest choice is to hire a lawyer as they can make it bulletproof. It is best to have two lawyers. Read Chapter 5 Solidifying Our Agreement from the story Contract Marriage I sit in front of the mirror in a white wedding gown, getting ready for my marriage. Some plot event in the first episode causes the 2 main characters to be forced to live together and (usually) pretend that they're married. The famous and popular dating game “Contract Marriage” has come back with more high quality scenarios and avatars! Lots of hot rich celebrity guys of. find a way to undo the marriage contract that unites them. But there is a problem, Goldring's magical contracts are only voided by its sovereign, but in. Send you application to: Gemeente Delft, Postbus 78, ME Delft. Personal visit. Would you prefer to visit the city desk ('stadskantoor')? In that case make. For example, you must be over the age of 18 and must have the mental capacity to enter into a contract. You cannot still be married to another living person. Instead of a ceremony, New York State Law permits a marriage to be solemnized by a written contract. Who is entitled to get copies of Marriage Records? Any. Learn about the types of marriage agreements you may enter into during the marriage process. Find out what agreements you may need besides a marriage contract. Ensuring that the marriage contract is legal and binding, the safest choice is to hire a lawyer as they can make it bulletproof. It is best to have two lawyers. Read Chapter 5 Solidifying Our Agreement from the story Contract Marriage I sit in front of the mirror in a white wedding gown, getting ready for my marriage. Some plot event in the first episode causes the 2 main characters to be forced to live together and (usually) pretend that they're married. The famous and popular dating game “Contract Marriage” has come back with more high quality scenarios and avatars! Lots of hot rich celebrity guys of. find a way to undo the marriage contract that unites them. But there is a problem, Goldring's magical contracts are only voided by its sovereign, but in. Send you application to: Gemeente Delft, Postbus 78, ME Delft. Personal visit. Would you prefer to visit the city desk ('stadskantoor')? In that case make. For example, you must be over the age of 18 and must have the mental capacity to enter into a contract. You cannot still be married to another living person. Instead of a ceremony, New York State Law permits a marriage to be solemnized by a written contract. Who is entitled to get copies of Marriage Records? Any. Learn about the types of marriage agreements you may enter into during the marriage process. Find out what agreements you may need besides a marriage contract.

How do I get legal capacity to contract marriage? These wedding requirements in the Philippines include a marriage license and a marriage certificate (sometimes called the marriage contract). Marry with the celebrities! You may find true love by the contract marriage?! The famous and popular dating game “Contract Marriage” has come back with more. The marriage contract should be in writing; · The marriage contract should be signed by both parties; · The signature of the spouses must be witnessed;. A prenuptial agreement is a contract that two parties enter into in contemplation of marriage. Prenuptial agreements are not just for the wealthy. A Certificate of Legal Capacity to Contract Marriage (LCCM) is issued ONLY to Filipinos presently residing in Japan who wish to get married to a foreign. Marriage contracts must be in writing, signed and witnessed for it to be formally valid and recognized as a domestic contract. The law in Ontario dictates how. Legal Capacity to Contract Marriage · Personal appearance of both applicants. · Duly accomplished CLCCM application form. · Applicants' passports (original and 1. There are no formal requirements regarding the contract. It need not to be evidenced by writing and the law prescribes no particular form of words. A promise by. The spouses can sign a marriage contract before they are married; it will come into effect on the day of the marriage. A person under the age of 18 who wants to. Marriage Contacts are for people about to get married This misconception stems from the term “prenup” which is often used interchangeably with marriage. One of the main reasons why couples are opting for contract marriages is to avoid court matters in the event of a divorce. This is because the. In general, the Philippine government requires all foreigners to obtain a "Legal Capacity to Contract Marriage" from his/her embassy before filing for a. GET STARTED TODAY! Explore College Courses · FAQ · Lawshelf News. Purchase a course multi-pack for yourself or a friend and save up to 50%!. 5-COURSE MULTI-PACK. The divorce proceeding, all of settlement costs here, marriage contract which someone can you must you can attend an email. Indian ones on what are the pr. Find. You can get a certificate of legal capacity to marry (verklaring van contract bearing your name and address. An official copy of your birth. SINGLE – PSA Certificate of No Record of Marriage (CENOMAR) duly authenticated by the Department of Foreign Affairs – 1 original + 1 photocopy. The CENOMAR must. The Marriage Contract (Marriage, 3) [Maxwell, Cathy] on Amazon And although she′d never met him, she′s determined to keep her word and make theirs a marriage. If you don't want your assets to be shared, you need to sign an antenuptial agreement before you get married. If you don't sign an antenuptial agreement, you'll.

How Often Do Navy Seals Deploy

Army Special Forces: Rangers, Night Stalkers and Green Berets · Marine Corps and Navy special operations forces: Raiders, Force RECON and SEAL teams · Air Force. Specialized Skills: Navy SEALs are masters of a wide range of skills necessary for their diverse missions. · Deployment: SEAL teams are often deployed in small. 62 weeks of initial training that includes Basic Underwater Demolition/SEAL BUD/S School, Parachute Jump School and SEAL Qualification Training (SQT) · 18 months. deployment and combat use by the UDT and SEAL Teams. There were six There were six different models or configurations of this SDV, where each involved often. When the Marine Corps couldn't provide the level of action that he sought, he made his way to the navy. During the grueling six-month SEAL training and. The guys that do get to work with the SDVs are a strategic national asset,” a former Navy SEAL operator told Sandboxx News. SDVs have two crew members: a pilot. Today, basic and advanced training for a Navy SEAL takes close to a full a year. Another 18 months of training with a SEAL team is now normal before a new SEAL. I often get asked by recruits about the recruiting process, BUD/S itself and life as a SEAL. My rule of thumb is that if you hear something about SEAL training. Boot Camp is seven to eight weeks long, depending on scheduling. Navy Boot Camp resides at the Recruit Training Command (RTC) in Great Lakes, Illinois, which is. Army Special Forces: Rangers, Night Stalkers and Green Berets · Marine Corps and Navy special operations forces: Raiders, Force RECON and SEAL teams · Air Force. Specialized Skills: Navy SEALs are masters of a wide range of skills necessary for their diverse missions. · Deployment: SEAL teams are often deployed in small. 62 weeks of initial training that includes Basic Underwater Demolition/SEAL BUD/S School, Parachute Jump School and SEAL Qualification Training (SQT) · 18 months. deployment and combat use by the UDT and SEAL Teams. There were six There were six different models or configurations of this SDV, where each involved often. When the Marine Corps couldn't provide the level of action that he sought, he made his way to the navy. During the grueling six-month SEAL training and. The guys that do get to work with the SDVs are a strategic national asset,” a former Navy SEAL operator told Sandboxx News. SDVs have two crew members: a pilot. Today, basic and advanced training for a Navy SEAL takes close to a full a year. Another 18 months of training with a SEAL team is now normal before a new SEAL. I often get asked by recruits about the recruiting process, BUD/S itself and life as a SEAL. My rule of thumb is that if you hear something about SEAL training. Boot Camp is seven to eight weeks long, depending on scheduling. Navy Boot Camp resides at the Recruit Training Command (RTC) in Great Lakes, Illinois, which is.

A SEAL Platoon is the largest operational element normally used to conduct a tactical mission. More often, SEALs operate as 8-man Squads or 4-man Fire Teams. How Often Do Reservists Serve? Navy Reserve service is generally There is no formula for determining who will deploy or when, where and for how long. Things change when you deploy. You essentially leave your homeport's fleet Navy Personnel Command seal · Bureau of Medicine and Surgery. Bureau of. The United States should invest in a fleet of long SEAL teams should be assigned geographical mission areas and deploy forward, with perhaps half of NSW's. The average member of the United States Navy's Sea, Air, Land Teams (SEALs) spends over a year in a series of formal training environments before being. Typically, a new Enlisted SEAL will go straight to a SEAL Team or SDV Team for his initial tour and stay there for years doing training, workups, and. Want elite Special Operations Forces training and deployments part-time? Army, Navy, Air Force Reserves or Guard offer options! Shortly after being established in January , SEAL Team ONE deployed Read the story of what happened when highly trained U.S. Navy SEAL assault. and SEALs should focus on tactics, techniques, and procedures that will enable the. SEALs to use their own Special Operations tasks to support the Marine. In order for your deployed family member to make a long distance call stornik.ru · stornik.ru Jacksonville Naval Air Station MWR. The eight teams allow a more stable continuous deployment cycle. One team from each coast will be deployed overseas for six months. This team will be. As the first to often make amphibious landings, the UDTs began making signs to welcome the Marines, indicating they had been there first, to foster the. Extended operations away from home port can last up to 6 to 9 months, and ships typically deploy once every months. This varies depending on the mission. Training and deployment · squads and fire teams as needed. Several platoons plus headquarters and other elements make up a SEAL team; each team is assigned to a. DF: How long does that take normally would you guess? You normally deploy, deploy every two years, but depending on when you. There is a Reserve SEAL Team?” “How often have you deployed since leaving Active?” “Wait, where do you live?” I get these questions a lot. Navy, was going to do a quick two years and get out. I was assigned to the does that change when you're deployed. C: No, it's pretty. A Navy carrier strike group got a first glimpse at what future operations do the command and control, how we would tactically employ all those forces. All Navy SEALs go through the six month Basic Underwater Demolition/SEAL, (BUD/S), Training at the Naval Special Warfare Center. Upon completion of BUD/S, all. In order for your deployed family member to make a long distance call stornik.ru · stornik.ru Jacksonville Naval Air Station MWR.

How Does Financing Work To Build A House

Getting preapproved by a bank for a construction loan is step number one. “This will tell you how much money the bank is willing to lend toward construction of. The basic idea of how a construction loan works is fairly straightforward. You apply for this type of loan when you are ready to begin building a home, and you. A construction loan can be used to cover the costs of building a new home or renovating an existing home. The buyer does have to re-qualify for the mortgage once building is complete. Additionally, with a two-step home construction loan, though only interest is due. This loan allows you to finance the construction of your new home. When your home is built, the lender converts the loan balance into a permanent mortgage. A construction loan is typically a short-term, high-interest mortgage that helps finance construction on a property. Construction mortgages are specifically intended to finance the construction of a house from scratch, from its foundation to its finishing touches. A construction loan draw schedule is a detailed payment plan for the home construction project and details how TD Bank will disburse funds as the project. Most new home construction loans provide short-term funds designed to get you through the building stage of your project (six to 12 months) followed by a. Getting preapproved by a bank for a construction loan is step number one. “This will tell you how much money the bank is willing to lend toward construction of. The basic idea of how a construction loan works is fairly straightforward. You apply for this type of loan when you are ready to begin building a home, and you. A construction loan can be used to cover the costs of building a new home or renovating an existing home. The buyer does have to re-qualify for the mortgage once building is complete. Additionally, with a two-step home construction loan, though only interest is due. This loan allows you to finance the construction of your new home. When your home is built, the lender converts the loan balance into a permanent mortgage. A construction loan is typically a short-term, high-interest mortgage that helps finance construction on a property. Construction mortgages are specifically intended to finance the construction of a house from scratch, from its foundation to its finishing touches. A construction loan draw schedule is a detailed payment plan for the home construction project and details how TD Bank will disburse funds as the project. Most new home construction loans provide short-term funds designed to get you through the building stage of your project (six to 12 months) followed by a.

A construction-to-permanent loan can provide the funds needed to build your home while requiring interest-only payments only on the money you've withdrawn. After construction is complete, you can either refinance the construction loan into a permanent home mortgage or get a new loan to pay off the construction loan. How construction loans work When getting a construction loan, it's important to note that you won't receive one lump sum. Instead, the lender typically has. A construction loan covers the purchase of land and the cost of labor and construction materials. There are also cases where a construction loan is used to. A construction loan is used to finance the building or renovation of residential or commercial real estate. How do construction loans work? Construction loans are short-term loans that cover the cost of building a new home. These loans are usually shorter in. Your lender pays your contractor directly. While your lender may approve you for a certain amount, your contractor receives money only for the work they do. You. Also known as a bridge loan, construction-only loans are designed to be short-term and last only for the duration of construction. As your home is built, your. A home construction loan covers the cost of building a new home — or, sometimes, major renovations to an existing house — and the land the home sits on. Through this loan, you'll finance the cost of building a home with the option to include the land purchase as well. When your construction is almost finished. The loan term is usually short, typically lasting one year or less in most cases, and once the project is complete, the loan is converted or refinanced with a. A construction loan finances the building of your new home. As your home nears completion, you'll apply for a permanent mortgage that will be used to pay off. Unlike a lump sum loan, construction loans are similar to a line of credit, so interest is based only on the actual amount you borrow to complete each portion. A construction loan can be used to cover multiple costs associated with building a home, including land, labor, building permits, and materials. This loan automatically converts to a standard mortgage at the completion of construction. The lender may call the conversion a modification or a refinance, but. How it works: A construction loan provides temporary financing. Unlike a mortgage, on which you pay interest and principal, a construction loan only requires. Construction loans are typically interest-only and you will pay only on the money that has been disbursed. So your loan payments grow as progress is made and. Getting preapproved by a bank for a construction loan is step number one. “This will tell you how much money the bank is willing to lend toward construction of. Once building is complete, the construction loan converts to a permanent mortgage at the same interest rate you've been paying. You only go through one closing.