stornik.ru

Gainers & Losers

Interest Rate On Reverse Mortgage Canada

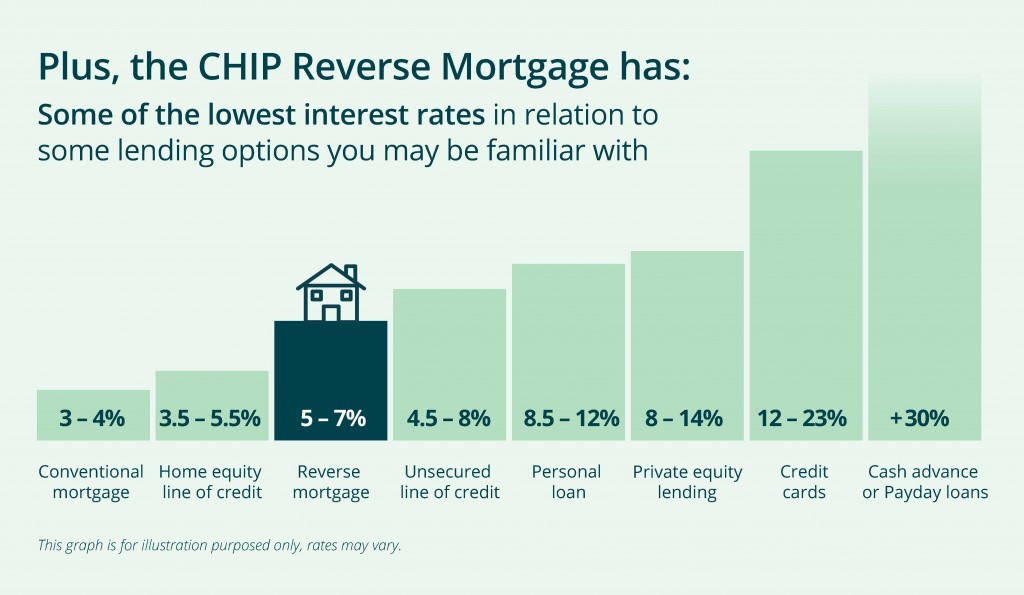

The current reverse mortgage interest rate by Equitable Bank ranges from to percent. Their lowest and highest reverse mortgage interest rates are. You should know that to qualify for a reverse mortgage in Canada, you have to be 60 years of age or older. A conventional mortgage or loan requires that you. The following is a summary of the current CHIP Reverse Mortgage interest rates and terms offered by HomeEquity Bank applicable upon reset. Slightly Higher fees and Interest Rates– The fees and interest rates assigned to reverse mortgage loans may be higher than traditional mortgages or lines of. Learn more about reverse mortgages in Canada, how they work, and if they're the A higher interest rate than you'd see with a traditional mortgage; A. In contrast to a Home Equity Line of Credit (HELOC), which requires at least interest payments, a reverse mortgage adds the accrued interest to the principal. View today's reverse mortgage interest rates & APR + read our 3 tips to help decide which interest rate is best for you! Disclosure: Prime Rate (P) is %. Equitable Flex Lite and CHIP Reverse Mortgage rates shown. Rates/fees for other EQ and HEB products may differ. Rates shown. The current reverse mortgage interest rate by Equitable Bank ranges from to percent. The current reverse mortgage interest rate by Equitable Bank ranges from to percent. Their lowest and highest reverse mortgage interest rates are. You should know that to qualify for a reverse mortgage in Canada, you have to be 60 years of age or older. A conventional mortgage or loan requires that you. The following is a summary of the current CHIP Reverse Mortgage interest rates and terms offered by HomeEquity Bank applicable upon reset. Slightly Higher fees and Interest Rates– The fees and interest rates assigned to reverse mortgage loans may be higher than traditional mortgages or lines of. Learn more about reverse mortgages in Canada, how they work, and if they're the A higher interest rate than you'd see with a traditional mortgage; A. In contrast to a Home Equity Line of Credit (HELOC), which requires at least interest payments, a reverse mortgage adds the accrued interest to the principal. View today's reverse mortgage interest rates & APR + read our 3 tips to help decide which interest rate is best for you! Disclosure: Prime Rate (P) is %. Equitable Flex Lite and CHIP Reverse Mortgage rates shown. Rates/fees for other EQ and HEB products may differ. Rates shown. The current reverse mortgage interest rate by Equitable Bank ranges from to percent.

Reverse Mortgage Interest Rates · 1 Year Fixed, %, % · 2 Year Fixed, %, % · 3 Year Fixed.

Our reverse mortgage interest rates start at our available low variable rate (download PDF below) and can be further reduced if you choose to pay the interest. Some seniors worry about the interest rates on reverse mortgages. They worry when they compare them to traditional mortgage rates. In an era of % interest. HomeEquity Bank Prime Rate: % Prepayment Charge & Other Calculators, CHIP Reverse Mortgage Income Advantage, Interest Rate Differential. For example, Canada's largest reverse mortgage provider currently charges % on reverse mortgages with a 5-year term. Meanwhile, major Canadian banks are. Reverse Mortgage Rates Canada ; 6-month Fixed · % Yr Fixed ; 1-year Fixed · % 1 Yr Fixed ; 2-year Fixed · % 2 Yr Fixed ; 3-year Fixed · % 3 Yr Fixed. Our reverse mortgage interest rates start at our available low variable rate (download PDF below) and can be further reduced if you choose to pay the interest. Reverse mortgages are subject to higher interest rates than most other types © Her majesty the Queen in Right of Canada (Financial Consumer Agency of Canada). Our % 6-Mo Fixed is the lowest mortgage rate available in Canada. We'll also deal with the lenders for you and secure your best rate, for a reverse. These. 3. Page 6. products take the form of an offer for a loan as a fraction of the equity of the house that can be borrowed and an interest rate. Using. What are the current reverse Bloom Finance reverse mortgage rates in Canada? See our transparent fees and rates here. Reverse mortgage terms and interest rates work largely the same as every other mortgage in Canada. You'll choose either a fixed or variable rate. There are 3 key factors in deciding how much you qualify for under a reverse mortgage: (1) the location of your home, (2) your age and (3) the property type. What is a Reverse Mortgage and How Does it Work in Ontario? If you owe money on your home but are considering a reverse mortgage in Toronto, qualifying for. There's also the option of paying down interest monthly, without a prepayment charge. Are reverse mortgage rates higher than standard mortgages? Because no. Canadian reverse mortgages do NOT affect any Old Age Security or Guaranteed Income Supplement government benefits you may already be receiving. You make. How Does a Reverse Mortgage Work in Canada? With a reverse mortgage, Canadian homeowners are able to borrow up to 55% of the value of their home, tax-free. If. Loan-to-value (LTV): Your interest rate increases as you borrow a larger percentage of your home's value. There are also additional fees to consider. Like most. Loan-to-value (LTV): Your interest rate increases as you borrow a larger percentage of your home's value. There are also additional fees to consider. Like most. Appraisal fees average $ Setup fees, including legal advice and title registration, average $ The appraisal fee is payable upfront and is not.

Types Of Casualty Insurance

Examples of commercial casualty insurance include workers' compensation insurance, general liability insurance, errors and omissions insurance and employers. General liability insurance is one of the most common forms of casualty insurance coverage. It offers protection to businesses and individuals against claims. Power sports insurance; Landlord insurance. Read on to learn about the types of property and casualty coverage offered in each of these insurance policies. For example, automobile insurance is a type of casualty product, as is homeowners' insurance, renters' insurance, or landlord insurance. In addition, it can. Property and casualty (P&C) is the term commonly used to describe insurance designed to protect an individual from loss or damage to the physical assets he or. Property insurance is a type of P&C insurance coverage that makes the insured whole in relation to losses and damages to personal or business property, such as. Property and casualty insurance is a broad term representing types of insurance, including auto, home, condo and renters. Types of property and casualty insurance · Homeowners insurance, · Renters insurance · Car insurance · Pet insurance · Earthquake insurance. There are two types of casualty insurance commercial and personal. There are several components that are included in insurance policies. The declaration page. Examples of commercial casualty insurance include workers' compensation insurance, general liability insurance, errors and omissions insurance and employers. General liability insurance is one of the most common forms of casualty insurance coverage. It offers protection to businesses and individuals against claims. Power sports insurance; Landlord insurance. Read on to learn about the types of property and casualty coverage offered in each of these insurance policies. For example, automobile insurance is a type of casualty product, as is homeowners' insurance, renters' insurance, or landlord insurance. In addition, it can. Property and casualty (P&C) is the term commonly used to describe insurance designed to protect an individual from loss or damage to the physical assets he or. Property insurance is a type of P&C insurance coverage that makes the insured whole in relation to losses and damages to personal or business property, such as. Property and casualty insurance is a broad term representing types of insurance, including auto, home, condo and renters. Types of property and casualty insurance · Homeowners insurance, · Renters insurance · Car insurance · Pet insurance · Earthquake insurance. There are two types of casualty insurance commercial and personal. There are several components that are included in insurance policies. The declaration page.

Liability coverage protects a company when a third-party makes a claim for property damage or injury resulting from a company's premises, operations or products. Types of coverage include student accident, sports accident, travel accident, blanket accident, specific accident or accidental death and dismemberment (AD&D). Commercial property and casualty insurance, also called commercial P&C insurance, combines two types of insurance to cover you for some of the most common. Property and casualty insurance, or P&C insurance, is a broad term that actually describes coverage that protects you against two types of financial losses. Casualty insurance can also be purchased as a stand-alone policy, such as a commercial general liability policy, professional liability policy, umbrella. Property and casualty (P&C) insurers provide coverage on assets and also liability insurance for accidents, injuries, and damage to other people or their. Property and casualty insurance is insurance that protects against property losses to your business, home or car and/or against legal liability. The Most Common Types of Commercial Property and Casualty Insurance · Commercial Property and Casualty Insurance · Commercial Automobile Insurance · Workers'. Property and casualty (P&C) insurance is a general term that describes various forms of insurance that can help protect you and your physical property. Property and Casualty insurance · Property and Casualty Lines · P&C Inspections Division · Statistical Plans · Actuarial Corner · P&C Data Calls · Reports and Studies. It may include marine insurance for shipwrecks or losses at sea, fidelity and surety insurance, earthquake insurance, political risk insurance, terrorism. Homeowners insurance is one type of property and casualty product, as is renters insurance, auto insurance, and powersports insurance. The term property and. Commercial insurance is divided into two main categories: property insurance and casualty insurance. Property insurance provides coverage for property that is. Casualty Insurance for Businesses and Professionals. Commercial General Liability. This coverage protects businesses when a person is injured on the premises or. Property-casualty insurance includes two major categories: commercial lines and personal lines. Commercial lines include insurance products designed for. Major classes of casualty insurance include liability, theft, aviation, workers' compensation, credit, and title. Liability insurance contracts may cover. Casualty insurance is a category of insurance that primarily focuses on providing coverage for the financial and legal obligations resulting from liability. What are the types of property and casualty insurance? · 1. Auto insurance · 2. Homeowners insurance · 3. Condo insurance · 4. Renters insurance · 5. “Toys”. Property and casualty insurance policies often come in bundles, such as a Businessowners Policy (BOP) that combines several types of insurance for your business. Property and Casualty insurance, also referred to as P&C insurance, is essentially joint coverage to protect you from certain risks.

Commercial Development Finance

Commercial property development finance is designed to allow developers or business owners to build new commercial properties. Commercial Market Representatives Long-term, fixed-rate financing available through mission-oriented, community-based SBA Certified Development Companies. Property finance for property developments is usually a short term loan that covers the costs of converting or renovating an existing property. Major Development Financial Programs Major Project Loans. The Major Projects Loan Program offers long term, fixed rate financing for large-scale commercial. With over 30 years' experience, MCAP provides customized financing solutions for developer, construction, and investor clients across Canada. Goldentree are one of only a few short term lenders who specialise in Commercial Development Finance. We take a look at commercial real estate loans, how they differ from residential loans, their characteristics, and what lenders look for. Hodge offers residential and alternative residential, and commercial development finance of up to £10m on single transactions for individuals, partnerships. Our commercial property development finance capabilities fund the ambitions of businesses and developers looking for their next investment opportunity. Commercial property development finance is designed to allow developers or business owners to build new commercial properties. Commercial Market Representatives Long-term, fixed-rate financing available through mission-oriented, community-based SBA Certified Development Companies. Property finance for property developments is usually a short term loan that covers the costs of converting or renovating an existing property. Major Development Financial Programs Major Project Loans. The Major Projects Loan Program offers long term, fixed rate financing for large-scale commercial. With over 30 years' experience, MCAP provides customized financing solutions for developer, construction, and investor clients across Canada. Goldentree are one of only a few short term lenders who specialise in Commercial Development Finance. We take a look at commercial real estate loans, how they differ from residential loans, their characteristics, and what lenders look for. Hodge offers residential and alternative residential, and commercial development finance of up to £10m on single transactions for individuals, partnerships. Our commercial property development finance capabilities fund the ambitions of businesses and developers looking for their next investment opportunity.

Commercial – Our Development Loan is tailored for developers aiming to Development Finance. Current Rate^: % Comparison Rate*: N/A Security Type. finance options relating to the property sector. Bridging loans, development finance, commercial mortgages and auction finance are all types of property finance. USDA Rural Development. Investing in the future starts with being committed to growth. Our experience with USDA programs dates back to the s. We are. BDC offers higher percentage of long-term financing to help you acquire real estate or expand facilities while preserving your working capital. A development loan is a short-term funding option to assist with the purchase and build costs of residential or commercial developments. Commercial development finance is funding for building new commercial property, to rent, sell or use as your own premises. Property Development Finance · Contact us · Loans from £1m to £50m · Maximum of 65% GDV · Quick turnaround · Flexible terms · Commercial Real Estate specialists · VAT. Planning a commercial development project? Together may be able to help if you have planning permission in place. Discover our development finance. Commercial lending · Development lending · Green lending. Investment. Care Development finance for residential development, Poole, Dorset. We provided a. We provide high quality commercial property development finance solutions for our clients. We pride ourselves on providing excellent service responsive to your. Commercial property development. This is development finance to develop or convert an existing property or properties into retail, commercial, or leisure space. We specialise in providing tailored commercial property financing solutions for developers and business owners involved in the construction, conversion, or. Property development finance is a short term loan for residential or commercial property developments, such as ground up construction projects or refurbishment. Expert property development finance and bespoke funding loans for residential and commercial projects. Speak to our brokers today for advice. Equally important, the construction/rehab phase receives funding from interest-only, mixed-use construction loans or commercial mortgage bridge loans. Banks and. Looking to finance your residential development project? Our commercial and real estate bankers are experienced in providing loans for land acquisition. Within the lending market, a specific property development finance product can fund the construction of residential, commercial, or mix-use premises. It covers. How do I pay a development loan back? Why should I use Positive Commercial Finance? Can you arrange finance if I have a CCJ or adverse credit? Do I need to have. Property development finance is money loaned to developers for the purchase of land or sites and the construction of new residential, commercial or mixed-use. However, borrowing funds to help finance this development takes time. It can commercial development funding. Additionally, it can impact the loan.

Trucking Billing Software

McLeod's Dedicated Billing module dramatically reduces the amount of labor required. Billing accuracy and auditability is ensured. The software provided by Trucksoft was designed with over-the-road and less-than-truckload companies in mind. In addition to accounting functions, the software. With OneBill, we have been able to seamlessly manage our entire billing process, from generating quotes to invoicing and collecting payments. List of The Best Trucking System | Trucking Dispatch Software · QuickBooks Payroll · AllRide Apps · Samsara · Motive · Manhattan Associates · Broker PRO · Trimble. Trucking accounting software is an invaluable tool for trucking companies. This type of software simplifies the process of tracking expenses, payments, and. To take advantage of this lucrative market, though, you need the right LTL billing software. That's one more reason to take TruckingOffice for a free day. Create and send invoices online and get paid faster with our invoicing software for logistics and trucking companies. Get a 7-day free trial! The best accounting software for trucking companies includes TruckLogics, Q7, Rigbooks, Axon, TruckBytes, TruckingOffice and Zoho Books. Truckbase is a cloud-based transportation TMS software designed to help small trucking companies manage dispatch scheduling, rate calculation, and invoicing. McLeod's Dedicated Billing module dramatically reduces the amount of labor required. Billing accuracy and auditability is ensured. The software provided by Trucksoft was designed with over-the-road and less-than-truckload companies in mind. In addition to accounting functions, the software. With OneBill, we have been able to seamlessly manage our entire billing process, from generating quotes to invoicing and collecting payments. List of The Best Trucking System | Trucking Dispatch Software · QuickBooks Payroll · AllRide Apps · Samsara · Motive · Manhattan Associates · Broker PRO · Trimble. Trucking accounting software is an invaluable tool for trucking companies. This type of software simplifies the process of tracking expenses, payments, and. To take advantage of this lucrative market, though, you need the right LTL billing software. That's one more reason to take TruckingOffice for a free day. Create and send invoices online and get paid faster with our invoicing software for logistics and trucking companies. Get a 7-day free trial! The best accounting software for trucking companies includes TruckLogics, Q7, Rigbooks, Axon, TruckBytes, TruckingOffice and Zoho Books. Truckbase is a cloud-based transportation TMS software designed to help small trucking companies manage dispatch scheduling, rate calculation, and invoicing.

Exspeedite trucking invoice software is able to track all your loads, from dispatch to invoice payment and simplifies billing for trucking companies. The trucking software provided by MyBizPad™ can help your trucking company invoice accurately, merge all the documentation you will need to collect and get. Trucking Invoice Software is an automated tool designed for generating, managing, and tracking invoices in the trucking industry. It aids freelancers, small and. A reliable accounting software is crucial for trucking businesses. This highlights how ZarMoney is your savior as the best trucking accounting software. Invoice trucking software will help you track your freight invoices so that you can make sure you are getting paid on time and getting full payment. And much more! Transport Billing. Freight Forwarding Billing. With NEO6, your billing will be quick, efficient and professional. Invoices will be. The Logical Way To Run Your Trucking Business · Quick and Easy Dispatching · One-Click Invoice Generation · Integrated Mobile App for Drivers and Managers · Simple. Trucking Invoice Software will help you to creates accurate invoices for Trucking Company. OTS allows to generate professional invoices in a few clicks. We'll explore the importance of accounting software in the trucking industry and present the top five accounting software solutions specifically tailored for. An automated AP management and trucking invoice software to streamline your transportation business cash flow. Truck Invoice is the simplest software to create invoices. The program involves the most important gadgets and features such as create a new client, new invoice. Axon is the ONLY trucking software that is totally integrated in real-time. This means that information entered anywhere in the system will automatically and. The Best 6 Trucking Accounting Software Options in · QuickBooks is one of the most popular accounting software options for small businesses and offers a. Trip Master is a transit management software which supports paratransit & NEMT operations with automated scheduling, reservation management, reporting, and more. Accounting software for trucking, aviation, shipping and all types of transportation companies. Sage Intacct helps automate invoicing, payment processing, cost. Strategy Systems offers trucking company accounting software for small trucking businesses that streamlines expense management tasks. For easier billing on the road, FreshBooks offers a trucking invoice template, free online, that you can download and fill in to generate an invoice, then email. Alvys automatically synchronizes every aspect of your freight brokerage billing and accounting. We integrate with top systems like QuickBooks, Microsoft. Trucking software typically manages shipping logistics, dispatching trucks, route planning, fleet management, truck maintenance records, delivery operations.

Can You Refinance A Vehicle

If you're paying too much in interest for your car or truck loan, refinancing could be a great way to save some serious dough. Interest rates for vehicle loans. As a best practice, it's ideal to wait at least one year before refinancing but you should have at least two years left on your loan. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. Car loan refinancing involves replacing an existing auto loan with a new one. The new loan typically has better terms, such as a lower interest rate or extended. How Do You Refinance a Car Loan? · Check Your Credit Score: If your bills were all paid on time since your vehicle was purchased, there is a good chance your. We are unable to refinance your current auto loan. However, we do offer our existing qualified customers an opportunity to purchase another vehicle. Refinancing your auto loan can lower your monthly payment and save you money long term. Learn how to refinance your car and when to consider it. You can refinance your car loan if you're not happy with the current monthly car payment or loan terms. Here's what you need to know. With our low rates, First Financial may be able to lower your monthly payments with an auto refinance. See how we make your vehicle refinance easy. If you're paying too much in interest for your car or truck loan, refinancing could be a great way to save some serious dough. Interest rates for vehicle loans. As a best practice, it's ideal to wait at least one year before refinancing but you should have at least two years left on your loan. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. Car loan refinancing involves replacing an existing auto loan with a new one. The new loan typically has better terms, such as a lower interest rate or extended. How Do You Refinance a Car Loan? · Check Your Credit Score: If your bills were all paid on time since your vehicle was purchased, there is a good chance your. We are unable to refinance your current auto loan. However, we do offer our existing qualified customers an opportunity to purchase another vehicle. Refinancing your auto loan can lower your monthly payment and save you money long term. Learn how to refinance your car and when to consider it. You can refinance your car loan if you're not happy with the current monthly car payment or loan terms. Here's what you need to know. With our low rates, First Financial may be able to lower your monthly payments with an auto refinance. See how we make your vehicle refinance easy.

You can refinance your car loan if you're not happy with the current monthly car payment or loan terms. Here's what you need to know. One way we do that is by providing lower rates that give you lower monthly payments with an auto refinance. When you get lower monthly payments on your car loan. If you're burdened with a high-interest loan for your cherished car, auto loan refinancing could be your ticket to substantial savings. Explore this guide to. If you previously had no credit or bad credit, it's worth checking into auto refinancing after a couple of years to see if you can get a better offer. An auto loan refinance can be a smart move in the right situations. By receiving a lower rate, you could cut your interest costs, reduce your monthly payment. Getting a lower rate is the crux of refinancing your auto loan. But did you know there's more to be gained when you refinance? We can help you get more than. With auto loan refinancing from PNC, you can refinance a car loan at a lower interest rate. Learn how it works and apply online today! Your Auto Loan. September 7, by Chevron Federal Credit Union Refinancing a car loan can be a smart financial move that can help you save money. From a practical standpoint, you may need to wait at least two to three months to refinance a car loan after purchase. The short answer is, generally yes! You can refinance a car loan but there are some things you need to consider before refinancing. The main question you must. An auto loan refinance can put more than just a few extra dollars in your wallet each month. Auto loan refinancing can save you hundreds of dollars in the long. Refinancing a car involves taking out a new auto loan and using it to pay off your existing loan. You might refinance your car to obtain a better interest rate. This can take place with your current lender or with a different one. To help you navigate this process, we're sharing the pros and cons of refinancing a. Refinancing your vehicle with Ally could help lower your monthly payment. Find out in minutes if you pre-qualify with no impact to your credit score. If you have equity in your car (and depending on its value) you can take out more than you owe on your existing car loan to get additional cash back to spend on. How to refinance a car loan in 5 steps · 1. Decide if refinancing makes sense for you · 2. Check your credit · 3. Gather relevant documents · 4. Ask the right. You can refinance an auto loan you currently have with us and borrow up to % of the retail value of your vehicle. You can typically do so as soon as the car title has been transferred to your name—a process that generally takes 60 to 90 days. Refinancing your vehicle to Resource One Credit Union is a great way to evaluate all of your options. When you refinance your auto loan, you can change the term. This can take place with your current lender or with a different one. To help you navigate this process, we're sharing the pros and cons of refinancing a.

Careington Dental Plan Reviews

BBB accredited since 9/10/ Dental Discount Plans in Frisco, TX. See BBB rating, reviews, complaints, get a quote & more. Consumer Driven Option members can save on dental care by using dentists in the Careington Dental Discount Network. Dental coverage is also available. I would recommend it to anyone without dental insurance, it is just as easy to use if you find a dentist that accepts it. Saved us hundreds if not thousands of dollars. Janet. This plan has saved me hundreds of dollars. Without this, I would not have been able to have procedures. Careington Benefit Solutions, Frisco, TX (Careington). Careington is not affiliated with MetLife or its affiliates. Like most benefits programs, benefit. "% SATISFIED with the plan, and very happy with the office staff, techs and dentists." "I love this plan! The price is reasonable, and my dentist is a member. 8 Customer Comments & Reviews This place is a ripoff and scam. After having the plan for a month and not having any coverage whatsoever, I decided to cancel. Careington Customer Reviews Thank you for helping me choose a plan my dentist accepts. The Careington plan is going to save our family quite a bit compared to. Careington Dental plans are very good plans, really the best there is. After having helped over 10, individuals to save money at the dentist with different. BBB accredited since 9/10/ Dental Discount Plans in Frisco, TX. See BBB rating, reviews, complaints, get a quote & more. Consumer Driven Option members can save on dental care by using dentists in the Careington Dental Discount Network. Dental coverage is also available. I would recommend it to anyone without dental insurance, it is just as easy to use if you find a dentist that accepts it. Saved us hundreds if not thousands of dollars. Janet. This plan has saved me hundreds of dollars. Without this, I would not have been able to have procedures. Careington Benefit Solutions, Frisco, TX (Careington). Careington is not affiliated with MetLife or its affiliates. Like most benefits programs, benefit. "% SATISFIED with the plan, and very happy with the office staff, techs and dentists." "I love this plan! The price is reasonable, and my dentist is a member. 8 Customer Comments & Reviews This place is a ripoff and scam. After having the plan for a month and not having any coverage whatsoever, I decided to cancel. Careington Customer Reviews Thank you for helping me choose a plan my dentist accepts. The Careington plan is going to save our family quite a bit compared to. Careington Dental plans are very good plans, really the best there is. After having helped over 10, individuals to save money at the dentist with different.

Careington International was a good place to work - senior executives seen in-office, CEO knew many employee names, benefits, pay scale and holiday calendar. The Careington Dental/Vision plan is NOT an insurance plan. It costs $/month (or $ if paid annually) and there is a one-time, non-refundable. Get the two top dental discount plans together for one low price. Save more at more dentists with the Careington Care plan + the Aetna Dental Access. Discount Plan Organization and administrator: Careington International Corporation, Gaylord Parkway, Frisco, TX ; phone () This plan. I signed up with Careington some years ago. I do not use this supplemental dental plan as we switched to Aetna. Be sure to let them know NCD is a PPO plan that utilizes the MaximumCare PPO networks including Careington, Connection Dental, and Dentemax. Need Help? What. I used the Careington Care plan from stornik.ru recently and it worked perfectly. The woman at the front desk recognized my plan immediately and. Save money with a Careington Dental Savings Plan. Careington Plans are perfect for individuals or businesses. Find yours today and save. Looking for an affordable way to save at the dentist? The Careington Dental Plan can save you 20%%, with no waiting to use. Since Processing inbound calls inquiring on dental and medical savings plan, enrolling clients and process credit card payment. Also verify medical benefits for all. Careington Dental plans are very good plans, really the best there is. After having helped over 10, individuals to save money at the dentist with different. “My savings were more than with the group plan I used to have at work.” · “I needed a root canal plus a crown. · “I thought this plan was too good to be true so. The plan also requires an additional yearly membership. However, considering the price of braces and other orthodontic appliances, it may be worth the fee. It. The Careington Care Plan is a dental discount plan designed to save members 20 % on their dental work. Coverage is paid according the plan design. Please review your policy for coverage details. All applicable co-pays, deductibles or co-insurance, outlined by the. Indeed Featured review a dysfunctional functional organization. inadequate planning and procedures to meet unrealistic goals. work is reactive and not. There are some complaints about Careington dental plans on ConsumerAffairs, although the plans are not necessarily all associated with the Care plan from. Find Careington Dentists & Providers with verified reviews. Make an appointment online instantly with Dentists that accept Careington insurance. It's free! Rhonda - Wichita, KS ; Rafael, Windermere, FL, Careington , First visit saved $1, on root canal & crown. ; Ronnie, Watkinsville, GA, Careington , Saved. Are you looking to save on your dental bills without compromising on the quality of care? Careington Dental Insurance could be your answer! With Careington, you.

Client Database Software For Small Business

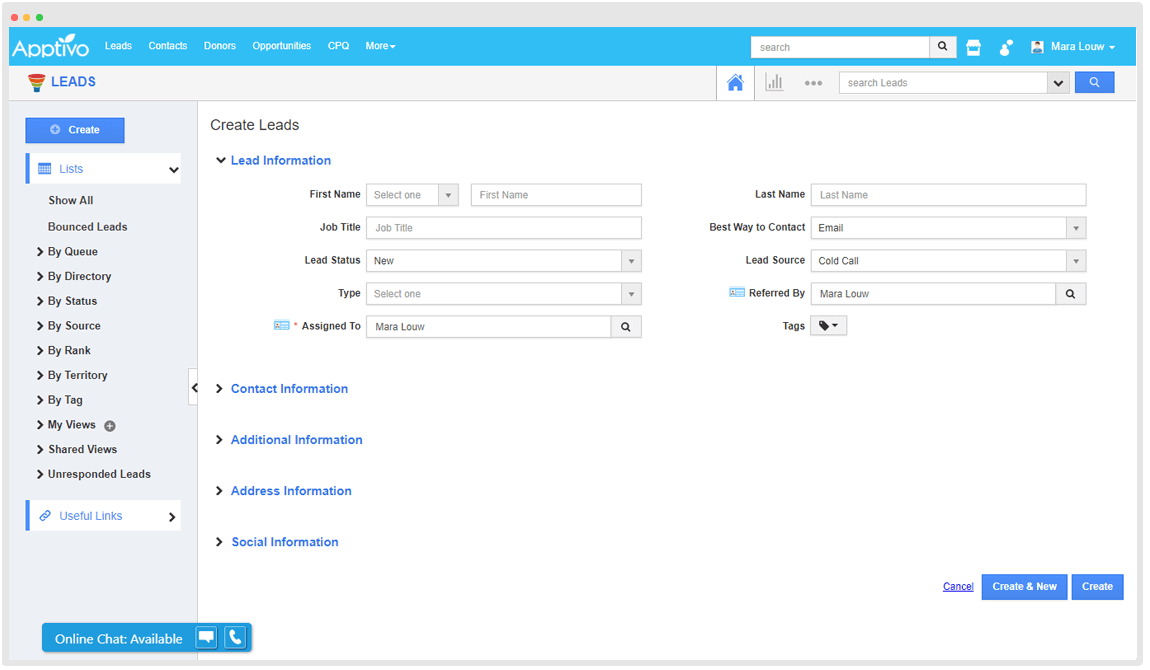

The end goal is improved sales for your business. Customer database software plays an important role in sales management, letting your teams manage more leads. Zoho CRM is a flexible cloud-based CRM for your business that helps you attract, retain and delight customers. 1M+. Free Customer Database Software for Small Business · EngageBay · Zoho CRM · HubSpot CRM · Freshworks · Agile CRM · Salesforce. Form builder; Email template builder; Ad management; Reporting dashboard; Contact management; Meeting scheduler; Document tracker; Customer feedback software. Overall, Salesforce is the perfect client relationship management software for small businesses. Key Features: Opportunity management allows you to track sales. Copper CRM is an easy-to-use CRM system that helps small businesses manage sales leads effectively and nurture customer relationships to drive business growth. Customer database software makes a business more flexible, reliable and scalable. It helps manage large volumes of user data, structuring contacts and. Manage Customer Base Hassle-Free Import or create a single database of existing and potential customers in Orderry to access your client-related data anytime. Contact Boss is a Web Based Client Management Software company that offers user-friendly online contact database software to small businesses for managing. The end goal is improved sales for your business. Customer database software plays an important role in sales management, letting your teams manage more leads. Zoho CRM is a flexible cloud-based CRM for your business that helps you attract, retain and delight customers. 1M+. Free Customer Database Software for Small Business · EngageBay · Zoho CRM · HubSpot CRM · Freshworks · Agile CRM · Salesforce. Form builder; Email template builder; Ad management; Reporting dashboard; Contact management; Meeting scheduler; Document tracker; Customer feedback software. Overall, Salesforce is the perfect client relationship management software for small businesses. Key Features: Opportunity management allows you to track sales. Copper CRM is an easy-to-use CRM system that helps small businesses manage sales leads effectively and nurture customer relationships to drive business growth. Customer database software makes a business more flexible, reliable and scalable. It helps manage large volumes of user data, structuring contacts and. Manage Customer Base Hassle-Free Import or create a single database of existing and potential customers in Orderry to access your client-related data anytime. Contact Boss is a Web Based Client Management Software company that offers user-friendly online contact database software to small businesses for managing.

Zoho CRM offers a vast number of customization options that can be leveraged to fit your business processes without coding knowledge or the help of a technical. 6 examples of database software to track clients · 1. Zendesk. Zendesk is a simple solution for companies seeking a client database. · 2. Zoho. Zoho is a CDS. Benefits of contact database software · Improved data organization and accessibility · Improved sales and marketing outcomes · Better insight into customer. CRM. Customer relationship management systems – dedicated software platforms designed specifically to manage interactions with customers. · Excel spreadsheets. Bitrix24 is the world's most popular free client database software. The online version comes with unlimited clients and is ready to be used in only 30 seconds. Copper is the best small business CRM software for startups, entrepreneurs and small businesses. Give it a try with a free trial today! Keap is the CRM software built exclusively for small businesses, making it easy to track and automate almost every aspect of client management. Acumatica Cloud ERP provides the best business management solution for small and midmarket organizations to transform their company to thrive in the new digital. Offering a unique and highly useful relationship-linking feature, Insightly CRM gives customers extra control over their sales operations. For small teams. Bitrix24 is a powerful customer database software that acts as a single source of truth for your business and provides a ° view of your customer - capturing. Some examples of free customer database software include HubSpot CRM, Zoho CRM, and Freshsales. Is free customer database software secure? Yes, most free. A customer database software is a tool, app, or platform that lets a business store, organize, and manage all information about its customers. This type of. Enter customer relationship management (CRM) software. These platforms have become indispensable to sales, marketing and support teams, helping them understand. This type of app basically acts like a customer and prospect database. They store all the details of your customers and keep track of (or record) your. Small Business. Resources. Developer Portal Store and access customer information and payment details in your secure customer database software. Flowlu's best client portal software for small business provides teams with the main point of communication between a company and its customers. Customer relationship management software, often shortened to CRM, is a software system that helps businesses store and manage contact information for customers. As a web, all-in-one CRM software, vcita provides services, key features, and tools to make small business owners' lives easier. Manage your clients. Gaining. CRM database software has become a necessary part of running a successful business. It is particularly important for small businesses looking to grow.

Cheapest Way To Exchange Currency

Avoid (or at least minimize) cash exchange. Exchanging money is expensive: You'll lose about 5 to 10 percent when converting dollars to euros or another. Some foreign exchange methods charge an additional fee on top of the spread that can significantly increasing your currency conversion cost. These fees can. Head to your bank or credit union before you leave to avoid paying ATM transaction costs. You may even receive a better exchange rate. Where else could you Send money abroad at a low cost in 25+ currencies. Is that how your provider does international money transfers? Didn't think so. How to avoid foreign transaction fees The easiest way to avoid foreign transaction fees is to get a credit card that doesn't apply them, if you don't already. Get the right money for your international destination with AAA Foreign Currency, provided by CXI. Convert US cash into the local currency to limit unexpected. In my experience, the best (cheapest) way of exchanging foreign currency is to use an ATM and withdraw an amount that you will use for the. Travel credit cards – near-perfect exchange rates and purchase protection · Travel debit cards – near-perfect exchange rates and no 'hard' credit check · Prepaid. Neobanks: The Best Place to Exchange Currency. For one of the cheapest ways to get cash from an ATM while abroad (and enjoy the additional products that come. Avoid (or at least minimize) cash exchange. Exchanging money is expensive: You'll lose about 5 to 10 percent when converting dollars to euros or another. Some foreign exchange methods charge an additional fee on top of the spread that can significantly increasing your currency conversion cost. These fees can. Head to your bank or credit union before you leave to avoid paying ATM transaction costs. You may even receive a better exchange rate. Where else could you Send money abroad at a low cost in 25+ currencies. Is that how your provider does international money transfers? Didn't think so. How to avoid foreign transaction fees The easiest way to avoid foreign transaction fees is to get a credit card that doesn't apply them, if you don't already. Get the right money for your international destination with AAA Foreign Currency, provided by CXI. Convert US cash into the local currency to limit unexpected. In my experience, the best (cheapest) way of exchanging foreign currency is to use an ATM and withdraw an amount that you will use for the. Travel credit cards – near-perfect exchange rates and purchase protection · Travel debit cards – near-perfect exchange rates and no 'hard' credit check · Prepaid. Neobanks: The Best Place to Exchange Currency. For one of the cheapest ways to get cash from an ATM while abroad (and enjoy the additional products that come.

foreign exchange can ways to send international wire transfers. Sending an international wire transfer in foreign currency lets you lock in an exchange. Exchanging your money at an airport is often the best choice. This is because the exchanges at the airport are always guaranteed to hold foreign currency for. exchange offices while you're away from home; Cost-effective way to take money abroad, instead of using ATMs and paying foreign transaction fees; Allows you. Automatic exchange rate conversions. When you sell in markets with local currencies, your online store prices are converted to your customer's currency. The. Many banks and credit unions allow you to exchange US currency for a relatively minimal cost, or none at all, and in the manner that best suits your needs. Currency exchange · No commission or fees · Great online rates · Order within 4 hours · Travelex Travel Money Card and app · Accepted globally · The secure way to pay. Avoid paying inflated prices for imported goods and services priced by vendors in U.S. dollars · Gain more control over the currency exchange process · Take. Travelex is probably the best-known currency exchange business, with several locations in central Washington, D.C., including K Street NW, Union Station. Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days · Exchange foreign currency for U.S. dollars when. Cost of advice. Already investing with us? Log on to Share Dealing. Introducing the new Ready-Made Pension. A simple, smart and easy way to save for your. Open a free Wise account online or in the Wise app to hold and exchange 50+ currencies. You'll get an exchange rate with no markup, and can spend without the. Our account holders can order foreign currency online or exchange foreign currency at a financial center. Learn more about our foreign currency exchange. Whether or not the wire transfer fee is waived, Wells Fargo makes money when we convert one currency to another currency for you. The exchange rate used when. Source ATM withdrawals might be the cheapest way to get foreign currency Some banks may offer foreign currency at reduced rates or ATM withdrawals that are. foreign currency bank notes. Find details about how to exchange currency here A quicker, simpler way to exchange currency. There's a convenient place to. Best & Worst Ways To Get Foreign Currency ; Debit Card, $0–$, Foreign Transaction/Exchange Fee: % (avg.)Foreign ATM Fee: $2–$5Foreign ATM Owner. HDFC Bank branches have forex services that let you buy foreign cash in 22 major currencies. Go to a forex dealer or travel agent: Similarly, you can buy. Our currency converter helps you to check today's exchange rates for over 50 currencies. Confirm and place your order. Order currency now. Collection and. Planning a trip abroad? Fifth Third Bank offers secure foreign currency exchange services so you have one less thing to worry about. Visit your local Fifth. Get the right money for your international destination with AAA Foreign Currency, provided by CXI. Convert US cash into the local currency to limit unexpected.

Axcelis Technologies Stock

The current price of ACLS is USD — it has increased by % in the past 24 hours. Watch Axcelis Technologies, Inc. stock price performance more closely. ACLS Stock Overview · Price-To-Earnings ratio (x) is below the US market (x) · Earnings are forecast to grow % per year · Earnings grew by % over. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ Data Provided by Refinitiv. Minimum 15 minutes delayed. ACLS Logo, Axcelis Technologies (ACLS) Stock Price: $ (%). Stocks / ACLS Stock / Summary. Stocks /. Axcelis Technologies, Inc. engages in the manufacture of capital equipment for the semiconductor chip manufacturing industry. It ion implantation systems. Axcelis Technologies Inc designs, manufactures and services ion implantation and other processing equipment used in the fabrication of semiconductor chips. Axcelis Technologies is one of the cheapest stocks in the chip sector, and it's packed with long-term potential. Axcelis Technologies Inc designs, manufactures and services ion implantation and other processing eq. Based on 6 Wall Street analysts offering 12 month price targets for Axcelis Technologies in the last 3 months. The average price target is $ with a high. The current price of ACLS is USD — it has increased by % in the past 24 hours. Watch Axcelis Technologies, Inc. stock price performance more closely. ACLS Stock Overview · Price-To-Earnings ratio (x) is below the US market (x) · Earnings are forecast to grow % per year · Earnings grew by % over. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ Data Provided by Refinitiv. Minimum 15 minutes delayed. ACLS Logo, Axcelis Technologies (ACLS) Stock Price: $ (%). Stocks / ACLS Stock / Summary. Stocks /. Axcelis Technologies, Inc. engages in the manufacture of capital equipment for the semiconductor chip manufacturing industry. It ion implantation systems. Axcelis Technologies Inc designs, manufactures and services ion implantation and other processing equipment used in the fabrication of semiconductor chips. Axcelis Technologies is one of the cheapest stocks in the chip sector, and it's packed with long-term potential. Axcelis Technologies Inc designs, manufactures and services ion implantation and other processing eq. Based on 6 Wall Street analysts offering 12 month price targets for Axcelis Technologies in the last 3 months. The average price target is $ with a high.

Axcelis Technologies, Inc. (stornik.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Axcelis Technologies. View the ACLS premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Axcelis Technologies. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. ACLS will report Key Stock Data · P/E Ratio (TTM). (08/22/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. ACLS. Discover real-time Axcelis Technologies, Inc. Common Stock (ACLS) stock prices, quotes, historical data, news, and Insights for informed trading and. Axcelis Technologies, Inc. (US:ACLS) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission . (NASDAQ: ACLS) Axcelis Technologies's week high was $, and its week low was $ It is currently % from its week high and % from. Axcelis Technologies Inc. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Axcelis Technologies Inc · AM, Upgrade to FINVIZ*Elite to get real-time quotes, intraday charts, and advanced charting tools. · AM, Upgrade to FINVIZ*. What are analysts forecasts for Axcelis Technologies stock? The 21 analysts offering price forecasts for Axcelis Technologies have a median target of Get Axcelis Technologies Inc (ACLS:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Axcelis Technologies, Inc. engages in the design, manufacture and service of dry strip, ion implantation and other processing equipment used in the. Based on short-term price targets offered by five analysts, the average price target for Axcelis Technologies comes to $ The forecasts range from a low. Innovative Ion Source Technology. Axcelis' innovative source technology, featuring H2 as a co-gas with fluorine based dopants, will optimize your implanter. Axcelis Technologies | ACLSStock Price | Live Quote | Historical Chart ; MACOM Technology Solutions, , , % ; Onto Innovation, , , %. Axcelis Technologies, Inc. designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips. Axcelis Technologies Inc ; Previous Close: ; Open: ; Volume: , ; 3 Month Average Trading Volume: ; Shares Out (Mil): See the latest Axcelis Technologies Inc stock price (ACLS:XNAS), related news, valuation, dividends and more to help you make your investing decisions. Axcelis Technologies, Inc. engages in the manufacture of capital equipment for the semiconductor chip manufacturing industry. Axcelis Technologies (ACLS) Q2 Earnings and Revenues Beat Estimates. Axcelis (ACLS) delivered earnings and revenue surprises of % and %, respectively.

How Far Back Do Lenders Look At Credit History

More than anything else, lenders want to get paid back. Accordingly, a potential borrower's track record of making on-time payments is of particular importance. Having an insufficient credit score does not mean the applicant has demonstrated inability or unwillingness to repay debt; it means the Loan Originator must. The 60 days thing is just to see if you've got the money and look for recent sketchy transactions. They're going to typically want 2 years of. When you take out a student loan, most lenders or servicers notify at least one of the three major credit reporting agencies. These are Equifax, Experian, or. So what what exactly is a credit score and how does it impact the car buying process? Image. What credit score do auto lenders look at? The three major. credit. Capacity to Pay Back the Loan. Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to. Mortgage lenders look back up to 4 years on foreclosure, short-sale, and deed in lieu of foreclosure; up to 10 years on bankruptcy;. What's Up With My Credit? - stornik.ru Lenders use credit scores to determine how much money they'll extend you for a home or car loan. How far back do mortgage lenders look? Mortgage lenders will usually assess the last six years of your credit history. Your credit report contains information. More than anything else, lenders want to get paid back. Accordingly, a potential borrower's track record of making on-time payments is of particular importance. Having an insufficient credit score does not mean the applicant has demonstrated inability or unwillingness to repay debt; it means the Loan Originator must. The 60 days thing is just to see if you've got the money and look for recent sketchy transactions. They're going to typically want 2 years of. When you take out a student loan, most lenders or servicers notify at least one of the three major credit reporting agencies. These are Equifax, Experian, or. So what what exactly is a credit score and how does it impact the car buying process? Image. What credit score do auto lenders look at? The three major. credit. Capacity to Pay Back the Loan. Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to. Mortgage lenders look back up to 4 years on foreclosure, short-sale, and deed in lieu of foreclosure; up to 10 years on bankruptcy;. What's Up With My Credit? - stornik.ru Lenders use credit scores to determine how much money they'll extend you for a home or car loan. How far back do mortgage lenders look? Mortgage lenders will usually assess the last six years of your credit history. Your credit report contains information.

5. Spending habits Lenders will usually closely examine your bank and credit statements for a period of up to six months to get an insight into your spending. Lastly, hard inquiries result when a potential lender, creditor or service provider requests a copy of your Equifax credit report in response to a request for. First, call your lender. At Atlantic Bay, our Mortgage Bankers are happy to do a “soft pullA look at your credit report that is not tied to any. How long information is kept by credit reference agencies. Information about you is usually held on your file for six years. Some information may be held for. Information remains on annual credit reports as follows: inquiries – 2 years, late payments – 7 years, paid tax liens – 7 years, unpaid tax liens – 15 years. That's because there are three main credit bureaus. Which one does the lender use? The answer is your "middle score." As the name suggests, the middle score is. General Requirements · The report must include both credit and public record information for each locality in which the borrower has resided during the most. The answer is yes. Keep in mind that within a day window, multiple credit checks from mortgage lenders only affects your credit rating as if it were a single. According to the stornik.ru report, employers typically assess applicants based on their long-term credit history — four to seven years overall — unlike. I think that mortgage rely on credit reports. Credit reports always have at least seven years of history. When I saw my last credit report it had three. For this reason, lenders can (for the most part) only use the past six years of your payment history when looking at your Credit Report to assess whether you. How Far Back Do Lenders Look? Mortgage lenders typically scrutinize the last two months of your bank statements. This comprehensive review includes all. 5. Spending habits Lenders will usually closely examine your bank and credit statements for a period of up to six months to get an insight into your spending. This allows lenders to get a good idea of your overall financial situation when looking through your bank statements and is enough time to determine whether you. What will lenders look for in my bank statements?. Lenders will usually ask for bank statements dating back to at least 3 months, and the underwriter may use. Lastly, hard inquiries result when a potential lender, creditor or service provider requests a copy of your Equifax credit report in response to a request for. Most information stays on your credit history for lenders and organisations to see for four to five years, eg default payments, bankruptcy, hardship. Some. For Freddie Mac-owned loans, 30 days' worth of statements might suffice. What is a Verification of Deposit (VOD) and do I need one? A verification of deposit is. The footprint is shown at the end of the report and shows those lenders who have enquired on your credit report in the last 5 years. However, a lender when. What can I do to show the lender I am reliable? During our time working in the mortgage industry, helping customers to obtain first time buyer mortgages or to.