stornik.ru

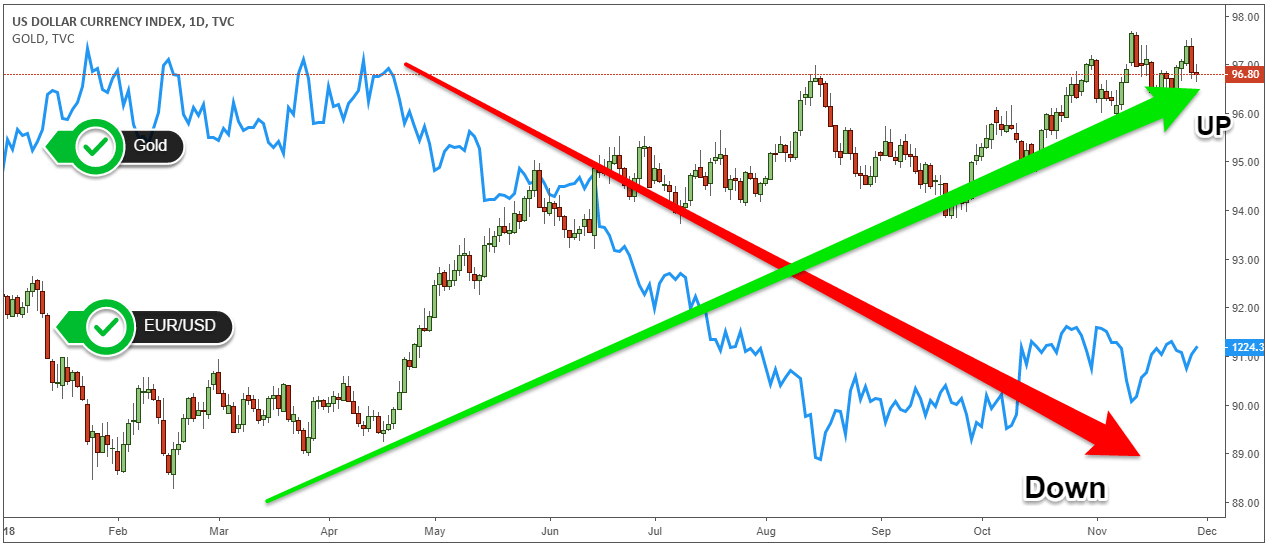

Community

What Does Hedging A Stock Mean

Hedging is an important protection that investors can use to protect their investments from sudden and unforeseen changes in financial markets. If the at-risk investment should decline in value, the hedge is designed to increase in value and offset potential losses in your portfolio. Hedging is a. Hedging is an advanced risk management strategy that involves buying or selling an investment to potentially help reduce the risk of loss of an existing. Currency hedging is an attempt to reduce the effects of currency fluctuations on investment performance. How does currency hedging work? There are two main. Hedging Inventory Definition. Hedging inventory—or hedge inventory—is inventory that a business has purchased in anticipation of a significant, uncontrollable. You can define hedging as an investment that's made to reduce the risks associated with another investment. Most often, investors will hedge to protect. Hedging is a financial strategy that protects an individual's finances from being exposed to a risky situation that may lead to loss of value. A hedge is an investment or trade designed to reduce your existing exposure to risk. The process of reducing risk via investments is called 'hedging'. A hedging strategy that investors use to minimise potential losses due to price fluctuations is a risk management strategy on the stock market. Hedging is an important protection that investors can use to protect their investments from sudden and unforeseen changes in financial markets. If the at-risk investment should decline in value, the hedge is designed to increase in value and offset potential losses in your portfolio. Hedging is a. Hedging is an advanced risk management strategy that involves buying or selling an investment to potentially help reduce the risk of loss of an existing. Currency hedging is an attempt to reduce the effects of currency fluctuations on investment performance. How does currency hedging work? There are two main. Hedging Inventory Definition. Hedging inventory—or hedge inventory—is inventory that a business has purchased in anticipation of a significant, uncontrollable. You can define hedging as an investment that's made to reduce the risks associated with another investment. Most often, investors will hedge to protect. Hedging is a financial strategy that protects an individual's finances from being exposed to a risky situation that may lead to loss of value. A hedge is an investment or trade designed to reduce your existing exposure to risk. The process of reducing risk via investments is called 'hedging'. A hedging strategy that investors use to minimise potential losses due to price fluctuations is a risk management strategy on the stock market.

For example, an investor worried about a potential drop in a long stock position might buy a put option to protect against this risk. To Stabalize Returns. A hedge is an investment to counter or minimize the risk of adverse price movements in an asset or security. Hedging is mainly done through derivative products. Page 2. • A March futures contract is purchases for a price of $ • For simplicity, assume the rancher antipates (and does sell) selling. 50, Hedging is a standard practice followed in the stock market by investors to safeguard themselves from the losses that might arise from market fluctuation. In the context of investing, hedging means limiting exposure in one position by taking on another position which is inversely correlated. You could buy NVIDIA stock and hedge that position by buying a put option so you limit downside risk. Hedging doesn't mean you can't have losses. When people opt to hedge, they are protecting themselves against the financial effect of a negative event. This does not preclude all bad occurrences from. meaning that if the value of the original investment goes down, the value of How does Hedging Work? Importance of Understanding Hedge in Investing. However, hedging doesn't necessarily mean that the investments won't lose value at all. Rather, in the event that happens, the losses will be. Hedging in stocks is a strategy where investors reduce their risk by taking an offsetting position in an asset. A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed. The hedging meaning in finance refers to holding two or more open positions when trading. If there are any losses from your first investment position, you'll be. What Does Hedge Mean In Trading? Hedging is the process of opening a trade position that seeks to offset the risk posed by another open position in the market. Optimal hedge ratio. The hedge ratio represents the proportion of an investment that is protected by a hedging instrument, such as futures, options, or CFDs. So the goal of a hedge in hedged equity is to offset the potential risk of loss in your equity (or stock) asset. The Investopedia definition mentions “taking an. A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment. Why do traders hedge and in which markets? · To offset liquidity risk in the share market. · In case of poor weather conditions, natural disasters or lack of. One way to do this is by investing in assets that are inversely correlated, meaning they tend to have the opposite reaction to the same market conditions. That. Staying in Cash: In this strategy, the investor keeps a part of his money in cash to hedge against possible losses in his investment. How do Investors Hedge. An.

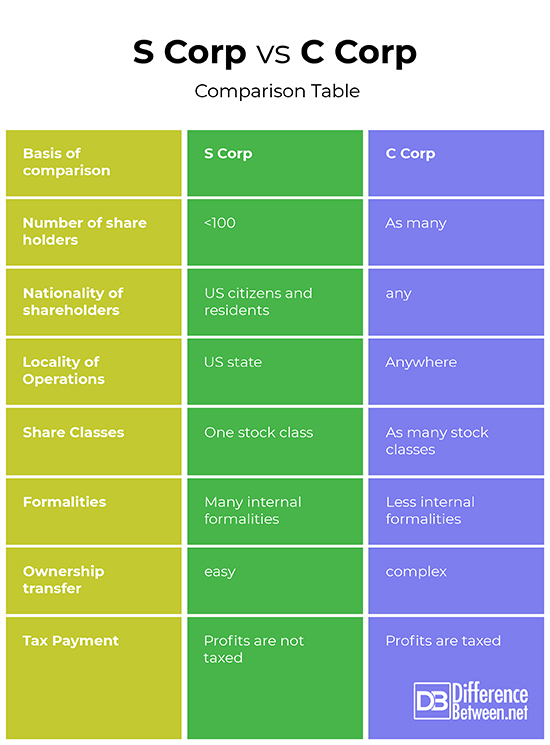

What Is C Corp Vs S Corp

An S corporation, sometimes called an S corp, is a special type of corporation that's designed to avoid the double taxation drawback of regular C corps. S corps. AC Corporation and an S Corporation are very similar in respect to liability protection. The main difference is in how you are taxed. A C corp can have an unlimited number of shareholders but must register with the SEC upon reaching specific thresholds. Unlike S corporations, which have. There is no difference between an “S” Corporation and a “C” Corporation. They are both separate legal entities that are formed to shield the. The S corp vs. C corp comparison brings to light a few important distinctions when it comes to taxes, ownership, and shareholder restrictions. Both corporation formats are governed by similar provisions regarding ownership and capital generation. They are separate legal entities that provide limited. Let's break down each entity to help you determine whether an S Corp or C Corp is the best fit for your business. C corps permit a wider range of stockholder types than S corps, giving them greater flexibility when seeking investors. S corp income flows to stockholders and. The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S. An S corporation, sometimes called an S corp, is a special type of corporation that's designed to avoid the double taxation drawback of regular C corps. S corps. AC Corporation and an S Corporation are very similar in respect to liability protection. The main difference is in how you are taxed. A C corp can have an unlimited number of shareholders but must register with the SEC upon reaching specific thresholds. Unlike S corporations, which have. There is no difference between an “S” Corporation and a “C” Corporation. They are both separate legal entities that are formed to shield the. The S corp vs. C corp comparison brings to light a few important distinctions when it comes to taxes, ownership, and shareholder restrictions. Both corporation formats are governed by similar provisions regarding ownership and capital generation. They are separate legal entities that provide limited. Let's break down each entity to help you determine whether an S Corp or C Corp is the best fit for your business. C corps permit a wider range of stockholder types than S corps, giving them greater flexibility when seeking investors. S corp income flows to stockholders and. The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S.

C-corps are subject to double taxation. Here, a company's profits are taxed first at the corporate level and again at the personal income level. The key difference between an S corporation and a C corporation is how they are taxed. C corporations are subject to double taxation. In the short article below I provide you with a bird's-eye view of how C corporations and how S corporations pay taxes and of the unique benefits that each. Sole Proprietorship. C Corp. S Corp. Limited Liability (LLC). Formation. Requirements,. Costs. Country Registration. Assumed Name. Notice. File articles of. The main difference between an S Corp and a C Corp is how they're taxed. C Corp status business owners pay taxes twice — at the corporate and individual level. S Corps are ideal for smaller businesses that want to avoid double taxation, while C Corps may be able to access lower corporate tax rates. S Corps offer more. S corporations enjoy the same benefits and must observe the same formalities required of C corporations but are not subject to double taxation. S corps provide. The main difference between a C and S Corporation is that C Corporations face double taxation and are separate entities, whereas one of the benefits of S Corp. C Corps offer more flexibility in selling shares of stock and can have unlimited shareholders of diverse types. S Corps, on the other hand, are limited to C Corporation vs. S Corporation An S corporation is another type of business structure that allows a company to pass its income, deductions, and losses to its. For federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. If you are a C corporation or an S corporation then you may be. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The C-corporation vs. S-corporation discussion should not impact your pre-incorporation decision. There is no distinction between the Certificate of. Difference 3. Ownership. A C-corporation will give you more options when it comes to selling stock. According to the IRS, a corporation that chooses S. Comparing C corp, S corp, and LLC: At a glance · C corporations, S corporations, and LLCs provide limited liability protection for the personal assets of the. LLCs and C corporations are the two primary corporate entities in the United States. Each entity type has some features that are more advantageous for some. We compare S corps, C corps and LLCs, including the tax implications for LLCs that elect to file as a corporation with the IRS. C corporations and S corporations are different tax designations available to corporations. Each has its pros and cons, and the best choice for you will depend. AC corporation becomes an S corporation only when, with the consent of all shareholders, special tax treatment (“pass-through taxation”) is sought.

Best Bank To Get Home Equity Line Of Credit

Best HELOC for high loan amounts: Flagstar Bank · Best HELOC for quick closing: Guaranteed Rate · Best for HELOCs with no closing costs: Bank of America · Best for. We're here to help you get a loan that best meets your needs. Call an Alliant home equity expert at An Alliant HELOC makes borrowing simple. Best HELOC Lenders of · Best Home Equity Line of Credit Lenders · New American Funding · Farmers Bank of Kansas City · AmeriSave · First Federal Bank. A HELOC is your home's equity working for you. Based on the equity of your home, you can secure a revolving line of credit, much like a credit card. Bethpage Federal Credit Union: Best home equity line of credit with a fixed-rate option · BMO: Best home equity line of credit for affordability · PenFed Credit. If you're looking for some help handling life's large expenses, a First American Home Equity Line of Credit (HELOC) from IL, FL and WI is a great solution. Best home equity loan lenders · Discover: Best for minimal fees. · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. Take advantage of a low home equity line of credit rate. Interest rate discounts available. Apply online at Bank of America. Best HELOC for high loan amounts: Flagstar Bank · Best HELOC for quick closing: Guaranteed Rate · Best for HELOCs with no closing costs: Bank of America · Best for. We're here to help you get a loan that best meets your needs. Call an Alliant home equity expert at An Alliant HELOC makes borrowing simple. Best HELOC Lenders of · Best Home Equity Line of Credit Lenders · New American Funding · Farmers Bank of Kansas City · AmeriSave · First Federal Bank. A HELOC is your home's equity working for you. Based on the equity of your home, you can secure a revolving line of credit, much like a credit card. Bethpage Federal Credit Union: Best home equity line of credit with a fixed-rate option · BMO: Best home equity line of credit for affordability · PenFed Credit. If you're looking for some help handling life's large expenses, a First American Home Equity Line of Credit (HELOC) from IL, FL and WI is a great solution. Best home equity loan lenders · Discover: Best for minimal fees. · Old National Bank: Best for fast closing times. · TD Bank: Best for variety of loan terms. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. Take advantage of a low home equity line of credit rate. Interest rate discounts available. Apply online at Bank of America.

With a HELOC, you can borrow against a portion of your total equity. Typically, lenders allow you to borrow a total combined amount of 75 to 90% of your home's. Get approved online with a fast approval process. No unnecessary fees. Quickly turn your home equity into cash by tapping into up to 90% of your property's. A HELOC may be the best option if you aren't sure when or how much money you need. If you do not draw money from your HELOC, you do not have to make any. KEMBA Financial Credit Union in Central OH offers low HELOC rates to help you cover unexpected expenses. Apply for a home equity line of credit today. Based on our research, our top home equity loan lenders are Navy Federal, US Bank and TD Bank due to their high max LTVs, competitive rates (as low as %). Best HELOC Lenders of September · Fifth Third Bank: Best HELOC Lender for a Rewards Credit Card · Flagstar Bank: Best HELOC Lender for High Limits · Bank. HomeTrust offers competitive home equity rates, plus: Fast closings – apply online with our state-of-the-art application system; No closing costs1 – be. A local credit union or bank branch may be a convenient option, but you can also search for a HELOC online. Because rates and terms differ, it's a good idea to. Use the equity in your home to borrow the amount you need at a low interest rate and start making memories today. Call us at or apply now to get. A 7 17 Credit Union Home Equity Loan or Line of Credit (HELOC) can help you use the equity of your Ohio home to finance large expenses. Apply online today. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Our best-in-class mobile app allows you to easily make payments, get an advance on your HELOC, access your tax documents, and more. HELOC Calculator. Is a HELOC. Requirements to get a HELOC · The amount of equity you have in your home · Your credit score and history · Your debt-to-income (DTI) ratio · Your income history. Fifth Third Equity Flexline · Draw money any time via check, card or ATM. You can also use online banking or visit a branch. ; Home Equity Loan · Receive money in. When you need extra money, Clearview Federal Credit Union in Pittsburgh's loans are there for you. Apply for a home equity loan or HELOC today. Get low rates & fast approval decisions on your SCCU home equity line of credit. Low initial draw requirements let you access your HELOC funds when you need. A home equity loan is a good choice when you're using equity for a specific amount and purpose because the loan lets you lock in a low rate and have fixed. We offer you low-interest rates. Why pay high rates to a big financial institution when your credit union has the best deals without the fine print? Get great. With a Liberty Bank low-rate home equity loan or line of credit, you can unleash your home's purchasing power to afford the things you want most. Carter Bank's Home Equity Line of Credit (HELOC) offers competitive rates to pay for purchases, projects or expenses. Schedule an appointment in VA or NC.

Investing In Debt Funds

Investing in debt funds has specific benefits over direct investment and indeed also over private equity funds. On the risk/return side, benefits include more. This article will explore the benefits of debt funds and walk you through the process of investing in them. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. Debt funds are mutual funds that invest your money in fixed-income securities for which interest is gained. Debt funds are mutual funds that use the money pooled from investors to invest in a wide range of debt instruments of varying tenures. Debt Funds provide the benefit of liquidity over other funds. These can be a better choice of investment over fixed deposits since the interest rate offered is. Investing in debt funds is a good option when you want to preserve your capital and at the same time want to earn better post-tax returns than FDs. It is also a. The best time to invest in Debt Funds is usually when interest rates are decreasing or expected to drop. When interest rates decrease, bond prices tend to rise. Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and/or institutional. Investing in debt funds has specific benefits over direct investment and indeed also over private equity funds. On the risk/return side, benefits include more. This article will explore the benefits of debt funds and walk you through the process of investing in them. A debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which core holdings are fixed income investments. Debt funds are mutual funds that invest your money in fixed-income securities for which interest is gained. Debt funds are mutual funds that use the money pooled from investors to invest in a wide range of debt instruments of varying tenures. Debt Funds provide the benefit of liquidity over other funds. These can be a better choice of investment over fixed deposits since the interest rate offered is. Investing in debt funds is a good option when you want to preserve your capital and at the same time want to earn better post-tax returns than FDs. It is also a. The best time to invest in Debt Funds is usually when interest rates are decreasing or expected to drop. When interest rates decrease, bond prices tend to rise. Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and/or institutional.

Looking to invest in Debt Mutual Fund? Start investing in numerous long term and short term debt funds offered by SBI Mutual fund. Dynamic bond funds invest in debt instruments with different maturities, depending on the prevailing interest rate regime. They are well-suited for investors. Walton Street Capital's Debt Fund platform is focused on originating and structuring debt investments on income producing commercial real estate. Debt creates a relationship of lender and borrower between two parties. The borrower raises money by issuing bonds while the investor looks to earn assured. A few major advantages of investing in debt funds are low cost structure, relatively stable returns, relatively high liquidity and reasonable safety. Debt funds. Debt funds are mutual funds that invest in fixed-income funds. Invest in debt mutual fund schemes online today at DSP to meet your long and short-term. Debt mutual funds have low risk ratio: Since these funds invest in fixed income securities, investing in debt mutual funds is considered to be far less risky. Debt financing occurs when a company raises money by selling debt instruments to investors. · Debt financing is the opposite of equity financing, which entails. Debt Funds are ideal for risk-averse investors to achieve their short to medium term goals. Invest in PGIM India Debt Funds. Debt funds are types of mutual funds that invest in fixed-income generating debt instruments. Debt funds are great investment products, especially for. Investing in Debt Mutual Funds can be integral to a well-balanced investment portfolio, offering stability while aiming for returns higher than traditional. Whether you're new or have been real estate debt investing for years, use this guide will get you ready real estate debt funds in Investments in debt instruments may be affected by changes in the No fund is a complete investment program and you may lose money investing in a fund. In the case of debt mutual funds, the loan is given by an investor to a government or a corporation. The borrower agrees to repay the principal amount at. Debt Funds are ideal for risk-averse investors to achieve their short to medium term goals. Invest in PGIM India Debt Funds. that offer capital appreciation. Debt funds are also referred to as Income Funds or Bond Funds. who should invest in a debt fund? Debt mutual funds can provide you with relatively stable returns at a lower risk than equity funds. It can also provide you with the diversification your. Investing in debt funds carries various types of risk. These risks include Credit risk, Interest rate risk, Inflation risk, reinvestment risk etc. Debt funds are mutual funds that invest in bonds and government notes. As long as you know what you're looking for and which debt funds to invest in, you may. Our Debt Funds use a range of debt instruments to provide funding solutions for a broad range of companies with very different capital profiles. Learn more.

Tradestation Fees Reddit

TradeStation International is expensive with a $5 fee and requires the creation of separate accounts for stocks, options, futures, and. The prompt in pic 1 pops up before I submitted a long order(see pic 2). My understanding was I was risking plus the Tradestation fees but. For micros, TradeStation charges $ in commissions and $ in fees, per contract, each way. Usually, as far as fees go, you only have to worry about the entry and exit, which is what is referred to as the round trip. For Tradestation. Transaction fees are a little bit higher than at IB, but there is no $10 inactivity fee or any other fee. So, TradeStation actually suits. For those of us that don't meet that threshold, the monthly fee amounts to $50 for the supply of data. As I also have an Interactive Brokers. This brokerage charges traders "mandatory corporate action fee" of $ Basically a fee for whatever the company you invest in has any corporate. Tradestation is more expensive than Tradovate and puts a lot of their information about their fees in the fine print. For example, if you use. So they charge you $ for the account service fee if you don't have 50 options contract traded OR shares traded OR have a $, TradeStation International is expensive with a $5 fee and requires the creation of separate accounts for stocks, options, futures, and. The prompt in pic 1 pops up before I submitted a long order(see pic 2). My understanding was I was risking plus the Tradestation fees but. For micros, TradeStation charges $ in commissions and $ in fees, per contract, each way. Usually, as far as fees go, you only have to worry about the entry and exit, which is what is referred to as the round trip. For Tradestation. Transaction fees are a little bit higher than at IB, but there is no $10 inactivity fee or any other fee. So, TradeStation actually suits. For those of us that don't meet that threshold, the monthly fee amounts to $50 for the supply of data. As I also have an Interactive Brokers. This brokerage charges traders "mandatory corporate action fee" of $ Basically a fee for whatever the company you invest in has any corporate. Tradestation is more expensive than Tradovate and puts a lot of their information about their fees in the fine print. For example, if you use. So they charge you $ for the account service fee if you don't have 50 options contract traded OR shares traded OR have a $,

Title. Currently using ninja trader and i hate it. but, at their free tier level, i'm paying for the exchange and NFA fee, that's the. But I would have hoped for some kind of notice or opportunity for me to catch my mistake before my trades and account got destroyed by fees. If you open a TS GO account there are no fees or minimum requirements, although there is a $10 trading charge if you use the desktop platform so. A couple months ago TradeStation sent an email saying they would wave charges for traders who are billed at least $40 in futures commissions the. $35 yearly Roth ira fee clearly show Tradestation is a nickel and dime operation. The having to transfer money from your equity account to. I'm sad neither has a decent community on Reddit. IBKR comes up a lot in the algo trading sub, but I've yet to identify focii for TradeStation. The commissions are okay for my style of trading but might be high if you are trying to scalp ticks on the micros or something. The mobile app. Their commission and fees on /MES is round trip per contract. You can integrate it with tradingview, but I wouldn't place trades on it . Tradestation International has outrageous fees. Charting is top notch, also Level 2 look is very clear. Upvote 2. Downvote Reply reply. I recently opened an account at Tradestation and messed with the simulator a lil bit. It showed $62 in fees for each buy and each sell. Tradestation has a promo going on for micro futures. I'm interested in signing up to trade /MES, but it looks like exchange fees are For TradeStation, there is no monthly fee to use the algo, just a minimum $10k account balance as already pointed out. $1 roundrip per contract micro in Tradestation. Upvote. My short lived experiment trading options directly with Tradestation has ended as after 1 trade. The commissions are absolutely vomit. Tradestation website says 60 cents a contract all in. No mention of 5 dollar flat plus a per contract fee. Just went a looked at my statements. Basically you had a IB account but with the pricing structure provided by TradeStation Global. Its main appeal was that it eliminated IB's $ They say that there are no commissions on any trades under 10k shares, but I'm seeing commissions rack up when im paper trading on their. - Fees are reasonable with the exception of data fees. Data is way more expensive than other big name brokers. - Fills are GREAT! I get. TradeStation is running a promotion right now for futures accounts - micros are only 25 cents commission (per side, per contract). I asked them. I'm on TradeStation and pay commissions of $ for MES plus $ fees. My futures data is free for CME. What data fees are they charging you?

Ira Promotions

Traditional IRA. Traditional IRA; Withdrawal Rules. Withdrawal Rules · 59 1/2 Use of study results in promotional materials is subject to a license fee. With higher fixed interest rates and tax advantages, CDs and IRAs are a smart, safe way to help your money work harder for your future. Reimagine what your retirement can do for you with a 1% match from SoFi on contributions to your Traditional or Roth IRA, up to the annual contribution limits. IRAs) and (b) investment account balances (investments available through our Wells Fargo may waive the monthly service fee at its discretion for promotional. Typical Duties Upon Promotion. Cadet staff officer, cadet deputy commander, or cadet commander. About Gen. Ira C. Eaker. General Ira C. Eaker was one of the. Earn More with our Promotional Rates. %. Annual Percentage Yield 6 IRA Facts to Help Give Your Retirement a Boost. Are you taking advantage of. Even though you make a qualifying deposit March 15th the promotion IRS guidance may impact your ability to make more than one IRA-to-IRA rollover in a one-. $ Minimum – All New Money Required. Open Today · Online Form. Promotional Term Certificates & IRA Certificates. Tier. $ - $9, $10, - $89, 15 votes, 67 comments. What's up with this promotion? Is it a % match? And only for a limited time? Please let me know if anyone knows. Traditional IRA. Traditional IRA; Withdrawal Rules. Withdrawal Rules · 59 1/2 Use of study results in promotional materials is subject to a license fee. With higher fixed interest rates and tax advantages, CDs and IRAs are a smart, safe way to help your money work harder for your future. Reimagine what your retirement can do for you with a 1% match from SoFi on contributions to your Traditional or Roth IRA, up to the annual contribution limits. IRAs) and (b) investment account balances (investments available through our Wells Fargo may waive the monthly service fee at its discretion for promotional. Typical Duties Upon Promotion. Cadet staff officer, cadet deputy commander, or cadet commander. About Gen. Ira C. Eaker. General Ira C. Eaker was one of the. Earn More with our Promotional Rates. %. Annual Percentage Yield 6 IRA Facts to Help Give Your Retirement a Boost. Are you taking advantage of. Even though you make a qualifying deposit March 15th the promotion IRS guidance may impact your ability to make more than one IRA-to-IRA rollover in a one-. $ Minimum – All New Money Required. Open Today · Online Form. Promotional Term Certificates & IRA Certificates. Tier. $ - $9, $10, - $89, 15 votes, 67 comments. What's up with this promotion? Is it a % match? And only for a limited time? Please let me know if anyone knows.

Use promo code REWARD24 only once for one account. Fund your new account within 60 calendar days of account opening. Cash credits will be granted based on. Univest offers competitive CD & IRA terms and rates. Take advantage of our promotional rates and terms. Open a CD or IRA with Univest today! IRA allows you to take advantage of both long-term compounding and tax Insured by NCUA. Certificate Promotion chart comparing terms in months to annual. R&D Hawai'i Island Visitor Promotions Grant · Foundation Grant Sources The IRA is a piece of legislation passed in August of that sets aside. Ally Invest Promotion: Ally Invest is currently offering new customers up to $3, in bonus cash. Best IRA for Peer-to-Peer (P2P) Investing. Prosper logo. Can I contribute to an IRA Certificate if I already have an IRA? Discover the latest in products, services, promotions, special offers, events, and more from. Features · $ minimum deposit to open the account (Special Promotions may require different minimum deposits). · Variable interest rates, rising interest rates. Promotional IRA Certificate Rates. Month Promotional IRA Certificate APYs 1. % APY on balances of $ to $49, Choose a Traditional IRA, Roth IRA, or Coverdell ESA and save for Special 7 Month Promo. $1, Minimum. n/a. $25, Minimum. % APY** ($2, What's the IRA match? How is the IRA match calculated? Which contributions are eligible to earn the IRA match? How much can I earn? Promotions · Savings · CDs · Student Banking · IRAs · Rates · Business Checking · Business IRAs are insured by the FDIC up to $, IRA contribution limit. Certificates of Deposit · Current CD Account Rates · Current Promotional Rates · Certificates of Deposit* · Premium Gold Certificates of Deposit*. Summer Service Event at Ira Subaru · Protect the heart of your Subaru with Genuine Subaru Oil. · Savings for more miles to love! · Directions · Why Subaru Service? IRAs · Choose the Way You Save · Roth vs. Traditional · Roth IRA Options · Roth IRA Savings Account · Roth IRA Money Market Savings · Roth IRA 6-Month Promo CD · Roth. Non-Eligible Account Types. International customers; IRAs. IRA accounts are not eligible for promotional awards due to tax reasons. Promotional Period. New US. IRAs · Traditional · Roth · CESA · Money Market · Certificates · Current Promotions. Digital Services. Digital Banking · Bill Pay · eDocuments · Card Controls. Minimum deposit of $ for 6-month, month & month certificate of deposit (CD) promotional products. Available for consumer, business, and IRA/. Individual retirement accounts (IRAs). Save for your future your way. Owning a Vanguard IRA® means you get flexibility. We have a variety of accounts and. IRA. Rates. Special IRA Promotion. APY. Special IRA Promotion. APY. 5-Month Certificate. $ Minimum Deposit. Rate Sheet. %. 7-Month Certificate. $ No setup, administration or annual maintenance fees are charged on Star One IRA Accounts. Traditional IRA Your contribution may be tax-deductible.

Average Price Of Motorhome Insurance

Purchase Price: The cost of a motorhome can vary greatly. Smaller, secondhand motorhomes can start about $40,, whereas larger, brand-new. How much does RV insurance cost? Research shows that depending on how much you use your RV, annual motorhome insurance premiums can range from $ to $3, Class A motorhomes are the largest and most expensive vehicles to insure. The average insurance cost ranges from around $1, to $4, or more per year. For those who use their RV part-time, insurance premiums typically fall under $1, Alternatively, full-time RVers can expect to pay from $ to $3, Class A motorhomes are the largest and most expensive vehicles to insure. The average insurance cost ranges from around $1, to $4, or more per year. (that cost more than $,). Motor Home / RV Insurance. Motor Coach Insurance ; Prevost Bus; Millennium; Liberty; Marathon. How much does RV insurance cost in Alberta? Motorhome insurance starts at $ per year while trailer insurance starts at $ per year. Your rates will depend. RV Rental Damage Protection can range from $15 – $70 per day or per night depending on the type of RV or Trailer, the coverage and the company providing it. An example of insurance costs is as follows: For a Motorhome worth $,, the annual premium would be roughly $1, - $/month. Contact your. Purchase Price: The cost of a motorhome can vary greatly. Smaller, secondhand motorhomes can start about $40,, whereas larger, brand-new. How much does RV insurance cost? Research shows that depending on how much you use your RV, annual motorhome insurance premiums can range from $ to $3, Class A motorhomes are the largest and most expensive vehicles to insure. The average insurance cost ranges from around $1, to $4, or more per year. For those who use their RV part-time, insurance premiums typically fall under $1, Alternatively, full-time RVers can expect to pay from $ to $3, Class A motorhomes are the largest and most expensive vehicles to insure. The average insurance cost ranges from around $1, to $4, or more per year. (that cost more than $,). Motor Home / RV Insurance. Motor Coach Insurance ; Prevost Bus; Millennium; Liberty; Marathon. How much does RV insurance cost in Alberta? Motorhome insurance starts at $ per year while trailer insurance starts at $ per year. Your rates will depend. RV Rental Damage Protection can range from $15 – $70 per day or per night depending on the type of RV or Trailer, the coverage and the company providing it. An example of insurance costs is as follows: For a Motorhome worth $,, the annual premium would be roughly $1, - $/month. Contact your.

We get you the lowest RV insurance rates on the market to help you secure a policy that includes all the coverage options you require. mean your home or auto insurance policy provide the coverage you want. Your Farmers® agent can tell you about insurance designed for your RV. What Does. On average, you can expect to pay between $1, and $2, per year for RV insurance in Ohio. Keep in mind that this is just an average. Some people may. The average premium for a month RV insurance policy at Progressive for was $ for a travel trailer and $ for a motorhome. RV insurance starts at $ per year for trailers and around $ per year for motorhomes. The price goes up based on different factors. The value of the RV and. According to estimates, the average annual insurance premium for a gas-powered Class A motorhome is approximately $1,$1,, based on usage of days per. The cost for coverage varies wildly, which is why RV warranty companies ask RVers for information about their rig before providing a quote. Warranty prices can. Due to their smaller size, Class B RVs are the easiest to drive (it's hardly different from driving a normal car) and the cheapest to insure. Campervan by a. Potential average savings based on 09/ country-wide survey of new Cost will vary based on insurer and coverage selections. Good Sam Insurance. How Much Does RV Insurance Cost? The average driver purchasing RV insurance in Texas will pay between $1,$2, This is only an estimate because each. According to Finder Australia, the average cost to insure a motorhome ranges from several hundred dollars to over $ per year. It will also depend on. On average, Class A RV insurance can range from 1, to 5, dollars annually. Class B RVs are the smallest of the classes and, in turn, have the lowest costs. How much does RV insurance typically cost? Your cost is based on the type of RV, its value and age, coverage selections, your driving history and more. Do I. The national average cost of an RV policy is $1, a year, but every motorhome insurance typically costs more than travel trailer insurance. Your. We can help you find the right RV coverage for a great price. We'll walk you through each step including making sure you get any savings or discounts you. When I sold RVs a baseline average we quoted was $40–50 a month on a $20, unit. Average Motorhome Insurance Cost · Motorhome insurance: £ · Campervan insurance: £ Average Cost of Car Insurance · What Is Full Coverage? How Do Insurance Purchase price guarantee coverage. Cons: Website lacks detailed information. Start your free quote online today for all your RV insurance needs. State Farm has competitive rates with not only an easy claims process, but 24/7 customer. How much does class A motorhome insurance cost? You can insure your class A motorhome with a liability policy for as low as $ *Read the associated.

Falling In Love Online Without Meeting

If you feel embarrassed about meeting with an in-person counselor or prefer a casual type of therapy, consider reaching out to an online therapist. Online. I've lost interest in seeing anyone else, Katie, because I'm falling in love with you! P.S. I hope we can get together Friday evening. I'll call you. Letter. It's possible for someone to develop feelings for someone they haven't met in person, especially with the rise of online connections. “I don't know what to do, I think I'm falling for you.” “Here's my number, so call me maybe.” “All I can say is, it was enchanting to meet you.”. Can you fall in love with someone online without meeting him? How was it when you both met? Did your relationship work out? Robert and Lisa Firestone, have listed common psychological reasons that love scares us without us being fully aware: Love arouses anxiety and makes us feel. Do you want to meet her in person? If you don't want your interactions to stay online, it's obvious she's captured your heart. You want to see. In fact, on one of our walks a random guy driving a truck, slowed down, rolled his window down, just to say "I love seeing happy couples". We're not even dating. We are now on a month's solid break without communication, until I start figuring this out. It has been helpful to have the space. I have started seeing a. If you feel embarrassed about meeting with an in-person counselor or prefer a casual type of therapy, consider reaching out to an online therapist. Online. I've lost interest in seeing anyone else, Katie, because I'm falling in love with you! P.S. I hope we can get together Friday evening. I'll call you. Letter. It's possible for someone to develop feelings for someone they haven't met in person, especially with the rise of online connections. “I don't know what to do, I think I'm falling for you.” “Here's my number, so call me maybe.” “All I can say is, it was enchanting to meet you.”. Can you fall in love with someone online without meeting him? How was it when you both met? Did your relationship work out? Robert and Lisa Firestone, have listed common psychological reasons that love scares us without us being fully aware: Love arouses anxiety and makes us feel. Do you want to meet her in person? If you don't want your interactions to stay online, it's obvious she's captured your heart. You want to see. In fact, on one of our walks a random guy driving a truck, slowed down, rolled his window down, just to say "I love seeing happy couples". We're not even dating. We are now on a month's solid break without communication, until I start figuring this out. It has been helpful to have the space. I have started seeing a.

Without serotonin to keep an eye on proceedings, we experience the dopamine Meeting Boston singles: Boston Dating with EliteSingles · Dating in Miami. Should I travel to meet a guy I met online? (or girl). Falling in love with someone online from another country has many hurdles to overcome. There's no simple. We publish articles around emotional education: calm, fulfilment, perspective and self-awareness. | Falling in Love with a Stranger — Read now. online. Don't get me wrong, online dating can be totally fun when done right, but in my many years of using apps to meet people this way, it. Relationships forming over the Internet, in chat rooms, via emails, on message boards, on social media, and even through online gaming are common nowadays. It may start out the same way, whether it be meeting online or in person, each relationship veers off on its own path that's % unique to each. You fell in love with them because of who they were, not because they were a without seeing me. I told him if he leaves without seeing me next year. Here's a piece of expert advice from dating coach Evan Marc Katz on how to slow things down. guy falling in love with a sleeping beautiful woman How to Master. Experience has taught us that the majority of our relationships will fail. We'll try time and time again to meet that perfect partner. We'll put our hope and. If someone you meet online needs your bank account information to deposit money, they are most likely using your account to carry out other theft and fraud. I love my partner, but I can't stop thinking about this other man. I think Online. 24 hours / 7 days a week. Email us. Get a reply in 24 hours. love you until you love yourself. I don't think there's anything inherently wrong with online dating and studies have shown that more and more people are. After two marriages and two divorces and at 55, I found the love of my life online. I just can't imagine living the rest of my days without Brian. He inspires. Looking for love online? Protect Yourself Against Romance Scams. Protect I wish I knew this before I ever started going online to meet someone. I. Guys can fall in love with any girl who allows them to be themselves without judging and just being open to the ideas they formulate— no matter how silly they. They both want to feel the intense, obsessive, “I can't live without you” craving of early-stage romantic love. ” This “falling in love” feeling is really. Stream the best dating shows and reality competitions available on Netflix, including Love Is Blind, The Ultimatum, Love on the Spectrum, and Love Island. You meet someone special on a dating website or app. Do your friends or family say they're concerned about your new love interest? Search online for the type. But those hormones don't just kick in when you meet a potential love interest. You have to get to know them first. Psychologist Arthur Aron devised a set of. This is why the people we fall in love with almost always resemble I have entire online courses that deal with meeting and connecting with new people.

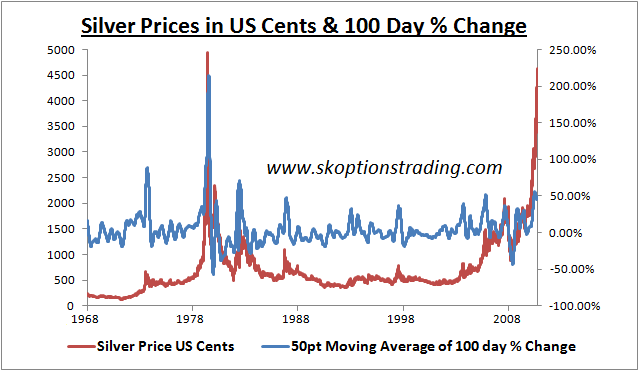

Is The Price Of Silver Going To Rise

Silver Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and %. The rate of silver is susceptible to conjecture and supply and demand. The silver price is closely followed by traders due to its potential for volatility. We are forecasting a price increase to $30 by the end of , which would bring the Gold/Silver ratio down to ”. For one, investors often pay a premium over the metal spot price on gold and silver coins because of manufacturing and distribution markups. Storage and even. As a result, the price of silver tends to decrease when the dollar is strong, highlighting silver's sensitivity to U.S. monetary policy and its. The United States debt ceiling crisis was a major factor in the rise of silver prices. Then, as it became likely that U.S. Secretary of Treasury. According to Trading Economics' global macro models and analysts' expectations, “silver is expected to trade at $ per troy ounce by the end of this quarter. BullionVault's Silver Price Live Chart ; 27 August , (GMT) ; $ · $ · 27 August , (GMT) ; £ · £ · 27 August. Yes it will continue to rise in the long term. By long term I mean yrs. When I 1st started buying silver in it was $20/oz for some. Silver Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and %. The rate of silver is susceptible to conjecture and supply and demand. The silver price is closely followed by traders due to its potential for volatility. We are forecasting a price increase to $30 by the end of , which would bring the Gold/Silver ratio down to ”. For one, investors often pay a premium over the metal spot price on gold and silver coins because of manufacturing and distribution markups. Storage and even. As a result, the price of silver tends to decrease when the dollar is strong, highlighting silver's sensitivity to U.S. monetary policy and its. The United States debt ceiling crisis was a major factor in the rise of silver prices. Then, as it became likely that U.S. Secretary of Treasury. According to Trading Economics' global macro models and analysts' expectations, “silver is expected to trade at $ per troy ounce by the end of this quarter. BullionVault's Silver Price Live Chart ; 27 August , (GMT) ; $ · $ · 27 August , (GMT) ; £ · £ · 27 August. Yes it will continue to rise in the long term. By long term I mean yrs. When I 1st started buying silver in it was $20/oz for some.

silver coins, with their historical significance and widespread recognition, are likely silver in these sectors rises, exerting upward pressure on its price. In the most recent survey % of respondents predict the price of silver will rise by 20% or more by the year end. Previous price trends are no guarantee of. Getting the Facts About Gold and Silver Prices. Your goal is to build wealth A sharp rise in precious metals prices suggests not all is well in the financial. News From WSJ Silver Continuous ContractSI 17 min ago. Energy & Utilities Roundup: Market Talk. 3 hours ago. Oil Prices Rise on Rising Levant, Libya Concerns. Compared to last week, the price of silver is up %, and it's up % from one month ago. The week silver price high is $31, while the week silver. A drop in oil prices and the dollar usually causes a rise in silver prices. prices are stable, silver is expected to become costlier inIndia. Political. Silver Continuous Contract ; 52 Week Range - ; Open Interest 36, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Silver price forecast on Friday, August, Dollars, maximum , minimum Silver price prediction on Monday, September, 2: Dollars. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis. This, and the lower overall price, make the price of silver much more volatile. The silver value can increase very quickly and by large amounts but can also. Silver increased USD/t. oz or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. There are specific times in India when the silver prices rise, and this mainly depends on the religious calendar of the majority population of people who follow. Live Silver Prices Europe ; Norwegian Krone/Oz, , ; Polish Zloty/Oz, , ; Russian Ruble/Oz, , ; Swedish Krona/Oz, The silver spot price market is open almost 24 hours per trading day, with a minute closed period each day between EST and 6 PM EST. The silver price. Prices tend to rise when the supplies are low. When the dollar weakens, investors begin to look to more stable investments like precious metals, such as. Silver tends to follow gold's price when gold rises (and it usually outperforms). That's based on the last 50 years of price history — there's. Citi: Silver prices may rise to around $32 per ounce in the second half of the year】Citi research analysts said in a research report that driven by. Silver Futures News & Analysis · More upside seen for silver prices in coming months, says UBS · Gold weakens, but rate cut bets, safe haven demand keep prices. Due to inflationary effects caused by newly passed stimulus bills by both the European Union and U.S. Government, Gold and Silver prices surge with. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis.

Sell On Etoro

Select BUY to open a long position, or SELL to open a short position. Enter the dollar value you wish to invest. Alternatively, click on. On Etoro, stop loss orders are designed to automatically close a trade when the price reaches a certain level in order to limit potential. “Selling” refers to “short selling”. This means you are opening a position where you believe that the Amazon stock will decline in value. Does eToro Allow Day Trading? Yes, eToro allows day trading, and many traders utilize the platform for this purpose. From leverage to tools like ProCharts, the. In order to open a new Buy or Sell position, it is necessary to have funds in your available balance. CFD trading is based on strategy and sentiment: An. How do I sell my stock on eToro? · Log into your eToro account and navigate to the “Portfolio” tab. · Find the stock you want to sell and click on the “Sell”. You need to "close the trade". Click on that menu at the far right of your position. That is the close (sell your stock) button. Selling means. The benefits of stock trading on eToro · Own the underlying asset · Receive dividends · Low minimum trade – just $10 · 4,+ stocks from 20 exchanges. If you have several positions on the same asset, you have the option to close all of them at the same time in one click. Learn here how to sell all trades. Select BUY to open a long position, or SELL to open a short position. Enter the dollar value you wish to invest. Alternatively, click on. On Etoro, stop loss orders are designed to automatically close a trade when the price reaches a certain level in order to limit potential. “Selling” refers to “short selling”. This means you are opening a position where you believe that the Amazon stock will decline in value. Does eToro Allow Day Trading? Yes, eToro allows day trading, and many traders utilize the platform for this purpose. From leverage to tools like ProCharts, the. In order to open a new Buy or Sell position, it is necessary to have funds in your available balance. CFD trading is based on strategy and sentiment: An. How do I sell my stock on eToro? · Log into your eToro account and navigate to the “Portfolio” tab. · Find the stock you want to sell and click on the “Sell”. You need to "close the trade". Click on that menu at the far right of your position. That is the close (sell your stock) button. Selling means. The benefits of stock trading on eToro · Own the underlying asset · Receive dividends · Low minimum trade – just $10 · 4,+ stocks from 20 exchanges. If you have several positions on the same asset, you have the option to close all of them at the same time in one click. Learn here how to sell all trades.

When buying cryptoassets on eToro, you gain ownership of those assets. eToro charges a single, simple, and transparent fee of 1% for buying or selling crypto. Buy and sell eToro stock. Get stock prices & access to pre-IPO shares in one place at Hiive. Yes, eToro and almost all privately held companies issue stock so founders, employees, and investors can participate in equity ownership. However, because eToro. This is to inform the public that the online investment trading platform E T O R O is. NOT AUTHORIZED TO SELL or OFFER SECURITIES to the public in the. Built for the modern investor. With smart investing tools, multiple assets, and a social community, eToro is the investing app built for today. Accredited investors can buy pre-IPO stock in companies like eToro through EquityZen funds. These investments are made available by existing eToro shareholders. To close out a short position, traders must complete a “buy” trade, which may cause the price to rise further and short sellers to panic and exit their. Unfortunately, eToro doesn't allow the short selling of real stocks. If you are looking for brokers that provide this service, check out this article about the. Unlike other apps, eToro allows you to easily create a diversified portfolio with no hidden costs. eToro is trusted by millions of users worldwide. Buy top. How to sell stocks at eToro · Log into your account using your credentials. · Go to your trading platform or portfolio page. · Select the stock you wish to sell. Opening a short position – also known as 'short selling' or 'going short' – involves borrowing an asset, selling it, and then purchasing it back later at a. Invest in thousands of stocks from leading markets and stock exchanges around the world. Analyze, discuss and trade along with over 30 million users. All you need to do is navigate to the Wallet tab, click “Get eToro Options” and follow the required prompts. If it's your first time trading options, you'll. How do i set a sell limit on eToro? Go to your portfolio, click on GME, scroll to the trade you want to set an order on, swipe right, click on. First, you'll need to complete the options account application on eToro. Once your options trading account is set up and verified, you can fund your options. On eToro, you can trade and invest in the world's most popular markets, and the most desirable assets. Access both traditional and innovative financial markets. Imagine you've invested in gold at a price of $ You set a Take Profit order on eToro to close your position if the price reaches $60 or higher. If the price. eToro Stock $ eToro is a multi-asset, social investment platform which offers investing in both stocks and digital assets, as well as trading CFDs. Their. The eToro investing platform and app · The most popular digital currencies and top US stocks · Low and transparent fees · Features for novices and experts.